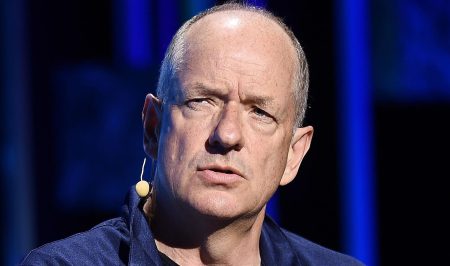

Rusty Wiley, CEO of Datasite, a leading SaaS technology provider for the M&A industry, discusses the challenges that global businesses are facing today, including interest rate and regulatory changes, geopolitical and economic uncertainty, and technological innovation. In response to these challenges, some businesses have expanded their executive teams to focus specifically on managing risks. Strategies used by M&A dealmakers, such as applying a decision-making framework, understanding the role of risk in business, and planning for uncontrollable outcomes, can provide guidance for navigating these complexities.

More than 75% of dealmakers in the U.S. and U.K. have worked on deals where concerns about a target company’s ESG factors prevented a deal from happening. With sell-side deal closure rates declining to 46% in 2023, completing a deal successfully has become more challenging. Deal makers focus on creating structure, alignment, prioritization, and communication when considering how to manage a proposed transaction. They remain flexible and agile to adapt to changing circumstances while staying on course to reach the desired outcome.

Technology plays a crucial role in helping dealmakers work smarter and faster in all phases of M&A. AI automates repetitive tasks, powers data analysis, and simplifies processes across the deal-making process. A 2023 Datasite survey found that dealmakers view productivity as the biggest benefit of using AI, with the potential to speed up M&A by up to 50%. AI-powered applications utilizing anonymized private equity and transaction activity help dealmakers identify better and faster deal pitch targets.

Managing risk in 2024 requires an understanding of current trends such as U.S. and U.K. political elections, interest rates, and inflation. Successive interest rate hikes by the Federal Reserve and other central banks have countered rising inflation, providing dealmakers with more certainty. Increased M&A activity is already being seen at Datasite, with a 14% spike in sell-side deal kickoffs in Q4 2023 compared to the previous year. This uptick in activity suggests a potentially busy year ahead for M&A, prompting dealmakers and business leaders to approach deals with a clear understanding of risk management and an appropriate framework to balance desired outcomes with potential risk factors.

This increase in deal volume presents both opportunities and challenges for dealmakers and business leaders. Staying on top of unfolding trends across local, national, and international jurisdictions is crucial to increase the probability of a deal progressing from origination to completion. With the right risk management strategies in place, dealmakers can navigate the complexities of the M&A landscape and seize opportunities for growth and expansion. Overall, technology, strategic planning, and adaptability are essential components for successful deal-making in today’s rapidly changing business environment.