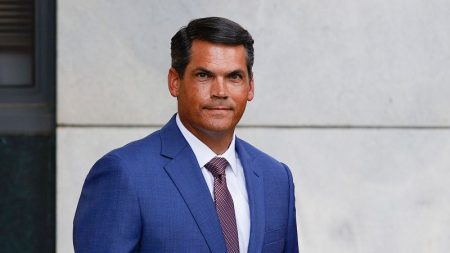

Richard Cordray, the head of the Federal Student Aid office, will be stepping down after facing criticism for the botched rollout of this year’s college financial aid form. Cordray has served as the chief operating officer of FSA since May 2021 and will stay on through June to help with the transition. The announcement of his departure follows problems with the new version of the Free Application for Federal Student Aid (FAFSA) that has caused delays and technical glitches, leaving millions of students unsure of the cost of college this fall.

Cordray became a focus of a hearing about the FAFSA rollout by the House Committee on Education and the Workforce earlier this month. The committee called for his resignation, citing concerns about the delays and glitches in the FAFSA process. Education Secretary Miguel Cardona acknowledged Cordray’s work on student loan forgiveness and accountability for schools that defrauded students but did not mention the FAFSA overhaul. Cordray’s tenure has seen significant changes in the student aid system, with millions of borrowers receiving loan forgiveness and improvements to the application process.

The overhaul of the FAFSA was intended to simplify the form and make more low-income students eligible for federal student aid such as Pell grants. However, the rollout of the new form has been plagued by problems, including delays in availability and technical glitches. FAFSA completions among high school seniors are down significantly, and errors in aid calculations have led to delays in colleges receiving information and processing forms. The Department of Education has faced criticism for its handling of the FAFSA rollout, with lawmakers on both sides calling for an investigation.

As head of FSA, Cordray oversaw the federal student loan system and played a key role in authorizing the cancellation of billions of dollars in student loan debt for borrowers who were defrauded by for-profit colleges. FSA also expanded loan forgiveness programs and launched a new income-driven repayment plan for low-income borrowers. Cordray’s tenure has been marked by efforts to protect student loan borrowers and hold schools accountable for fraudulent practices. His departure comes amid continued challenges in the student aid system and the need for further improvements.

During Cordray’s time as director of the Consumer Financial Protection Bureau, he prioritized protecting student loan borrowers and securing debt forgiveness for those affected by for-profit colleges. The agency also sued Navient, a major federal student loan servicer, for alleged payment processing errors. Cordray’s commitment to ensuring financial fairness for all Americans has earned praise from progressive lawmakers, including Massachusetts Sen. Elizabeth Warren. His departure from the FSA will leave a gap in leadership during a critical time for student loan borrowers and the financial aid system.

The Biden administration has defended the FAFSA overhaul as a necessary step to simplify the application process and make federal student aid more accessible to low-income students. However, delays and technical issues with the new form have hindered students’ ability to plan for college this fall. The Government Accountability Office has launched an investigation into the implementation of the new FAFSA, adding to the scrutiny facing the Department of Education. Cordray’s departure raises questions about the future direction of the FSA and efforts to improve the student aid system for borrowers.