The individual in the content is a 52-year-old who has accumulated a significant amount of student loan debt over the years, which has quadrupled from the original amount borrowed. They find the interest rates to be exorbitant and with inflation making it difficult to afford anything, they have resigned themselves to the fact that they will likely die with this debt, which they find very disheartening.

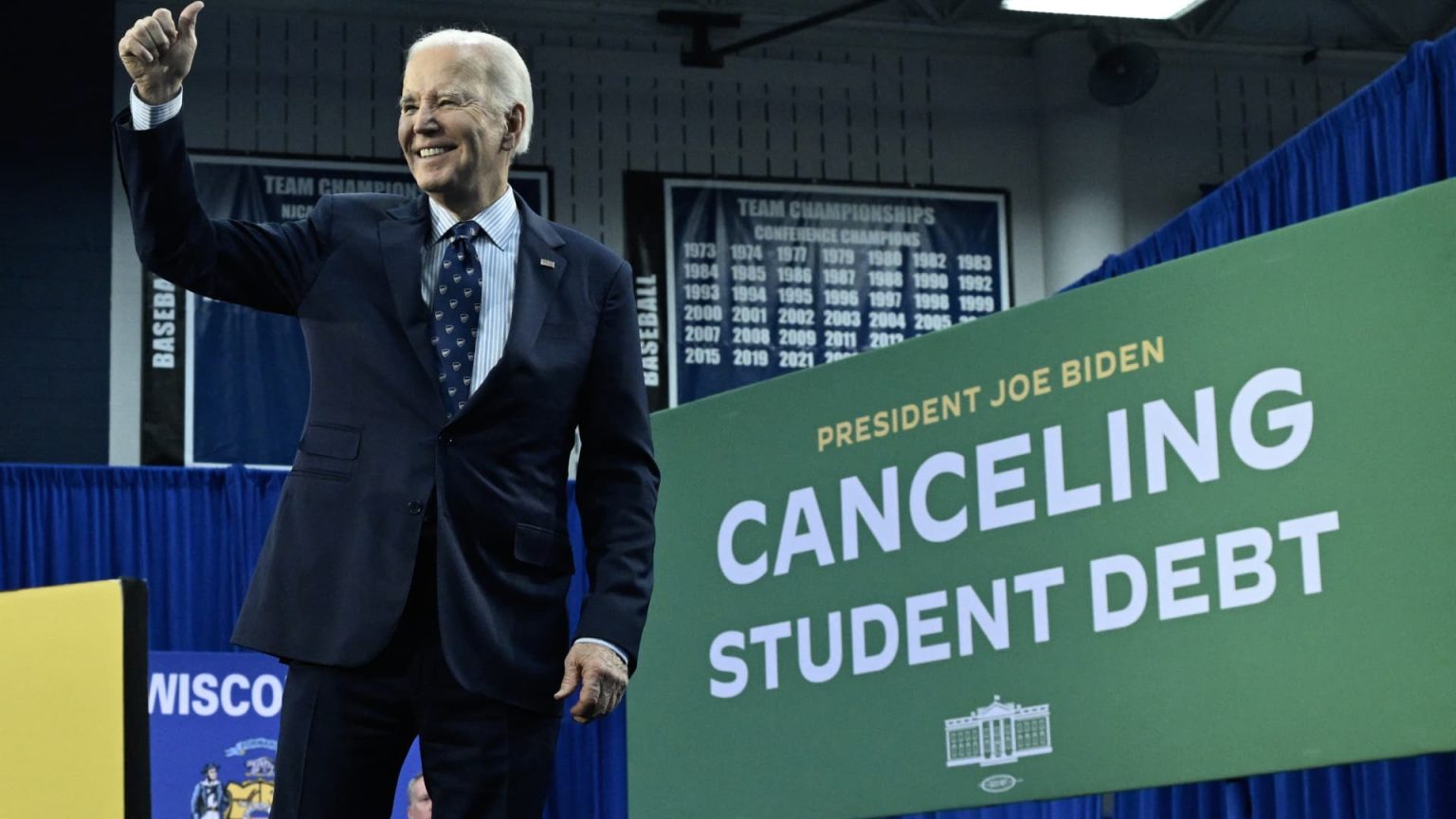

There is a call for the Biden administration to stop burdening Americans who did not attend college or have already paid off their student loan debt with the proposal of massive student loan debt cancellation. The argument is that this plan would force hardworking taxpayers, many of whom did not attend college, to foot the bill for those who did, including high-earning professionals like doctors and lawyers who are more than capable of paying off their debts.

Supporters of student loan debt relief argue that forgiving this debt would not only make individuals’ lives easier, but also stimulate local economies by allowing people to spend more money, benefiting small businesses and the community as a whole. They believe that this would create a positive impact that voters will remember when it comes time for elections.

An African American millennial from a low-income background voices the importance of supporting and approving student loan debt relief proposals. The argument is made that historically, African Americans have faced generational wealth disparities, making it necessary for many to rely on financial aid to pursue higher education. Eliminating student debt is seen as a crucial step towards rectifying long-standing inequities and empowering marginalized communities to achieve economic security and participation.

There is criticism towards the Biden administration for attempting to “purchase” votes through the proposal of student loan debt cancellation. The belief is that individuals should take responsibility for their personal decisions, including the choice to go to college, and not pass the burden onto taxpayers. Some argue that the government should not intervene in personal financial decisions, especially when it involves using taxpayer money to alleviate individual debts.

The younger generation, coming from working-class backgrounds, expresses the struggles they face with student loan debt, balancing various forms of debt such as mortgages and car notes. They emphasize the challenges of navigating complex repayment programs and trying to avoid saddling their own children with similar debt burdens. They view proposed rule changes that would provide relief for families with student loan debt as a welcome solution that cannot come soon enough.