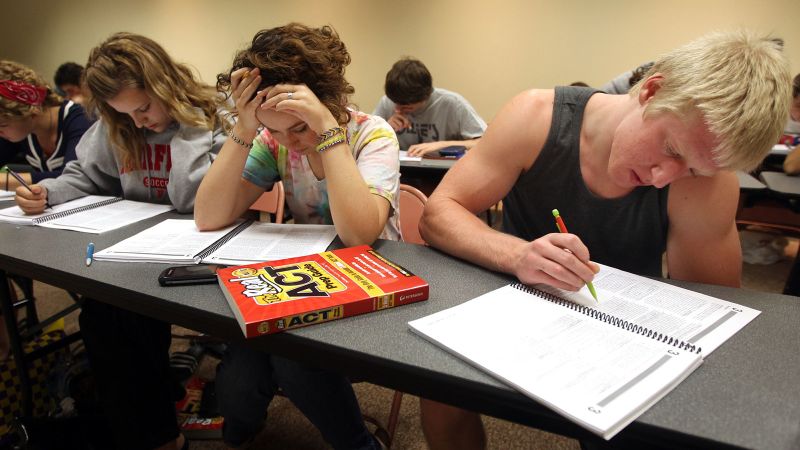

US college entrance exam companies have faced financial losses in recent years, prompting private equity firms to step in and take majority stakes in exchange for a cash infusion. ACT Inc., the nonprofit behind the ACT exam, recently announced a partnership with Nexus Capital Management to move its test into a for-profit company. While ACT CEO Janet Godwin believes this move will improve services beyond testing and address the workforce needs, some education advocates are concerned about the impact on transparency in the testing process.

Critics worry that private equity ownership of the ACT could reduce transparency and distort the evaluation process. Nonprofit companies are subject to regulatory oversight and disclosure requirements, which provide transparency and maintain public trust. The ACT’s transition to a for-profit corporation may raise concerns about potential conflicts of interest, especially if the private equity firm also owns a company that develops education materials, giving them control over the entire process.

Despite these concerns, ACT maintains that it will not immediately raise test prices and that the nonprofit entity will retain a minority interest in the company. Goodwin emphasizes that the partnership with Nexus is focused on creating long-term value and working transparently in education. However, critics remain skeptical, warning that profitability could come at the expense of students, particularly those from lower-income backgrounds.

The trend of private equity investment in education services is not limited to the ACT, as many testing companies have seen decreasing revenues and are seeking new financial support. The College Board, another nonprofit that administers the SAT exam, reported a significant drop in revenue from the SAT exam as colleges have shifted their testing requirements. Private equity firms are filling the funding gap in the education sector, raising concerns about potential impacts on students and the integrity of standardized testing.

Federal Reserve Chair Jerome Powell recently participated in a policy forum with the Bank of Canada governor, indicating that the Fed is unlikely to cut interest rates at the upcoming policy meeting due to inflation concerns. US stocks fluctuated in response to Powell’s comments, highlighting the impact of monetary policy decisions on market volatility. Inflation remains a key factor influencing the Fed’s policy decisions, as persistent price pressures in services and housing continue to affect consumer spending and economic growth.

United Airlines reported a financial setback in the first quarter due to ongoing quality issues with Boeing, resulting in a $200 million hit after the grounding of its 737 Max 9 jets. The grounding followed an incident on an Alaska Airlines flight, raising questions about the safety and quality of Boeing planes. United, which relies heavily on Boeing aircraft, faced additional costs and operational disruptions as a result of the grounding. The incident underscores the impact of quality issues in the aviation industry on airline operations and financial performance.