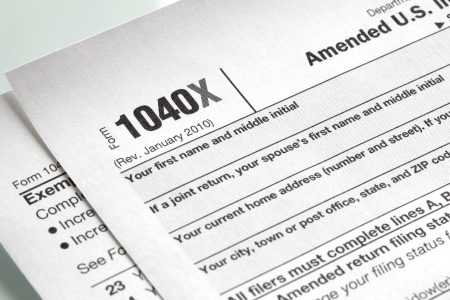

Despite the good intentions behind the $2.2 trillion CARES Act, some individuals have taken advantage of the relief programs designed to support American workers, families, and businesses during the pandemic. The IRS-Criminal Investigation (CI) has been diligently working to address COVID-related tax crimes and money laundering cases, uncovering potential fraud amounting to $8.9 billion. Over the past year, well over half of these cases have been opened, highlighting the rampant abuse of these programs.

Among the targeted relief programs were the Paycheck Protection Program (PPP) and Economic Injury Disaster Loans (EIDL), which were intended to provide financial support to small businesses struggling to stay afloat. While PPP loans offered the opportunity for loan forgiveness to eligible borrowers, EIDL funds had to be repaid. Unfortunately, as the demand for financial assistance increased, so did the instances of fraudulent activities, resulting in the need for extensive investigations by CI.

The efforts of CI have led to significant results, with 795 individuals indicted for COVID-related crimes and 373 individuals sentenced to federal prison. The high conviction rate of 98.5% in prosecuting fraud cases underscores CI’s commitment to upholding the law and protecting taxpayers from exploitation. The agency’s crucial role in safeguarding against fraud, particularly in pandemic-era programs, demonstrates the importance of its work in ensuring fairness within the nation’s tax system.

As CI continues to crack down on COVID-related fraud, recent cases have resulted in lengthy prison sentences for those found guilty of scamming the relief programs. Rami Saab, the mastermind behind a fraudulent loan scheme, was sentenced to 10 years in prison and ordered to pay millions in restitution. Similarly, Terrence L. Pounds received a 94-month prison sentence for his role in obtaining COVID-related loans under false pretenses. These cases serve as a warning to individuals looking to exploit government assistance programs for personal gain.

With the ongoing threat of fraud in pandemic relief programs, CI is urging the public to come forward with any information regarding suspected criminal activities tied to the CARES Act. The agency’s efforts to combat financial crimes, such as tax fraud, money laundering, and identity theft, highlight the importance of maintaining integrity within the tax system. CI’s dedication to investigating potential violations of the tax code underscores the agency’s commitment to upholding the law and protecting the nation against fraud.

As CI continues to investigate COVID-related fraud cases, the agency is expecting additional funding through the Inflation Reduction Act to support its ongoing efforts. With nearly 700 new investigations opened in the past year alone, totaling $5 billion in potential fraud, CI remains vigilant in pursuing fraudsters who take advantage of government loan programs. By encouraging the public to report any known or suspected fraudulent activities, CI aims to strengthen its fight against financial crimes and safeguard the integrity of relief programs intended to support those in need.