AMD reported first-quarter sales slightly ahead of Wall Street expectations, with earnings per share at 62 cents and revenue at $5.47 billion. The company also provided an in-line forecast for the current quarter, expecting about $5.7 billion in sales, representing about 6% annual growth. This compares to analyst estimates of $5.70 billion. AMD reported a net income of $123 million, up from a net loss of $139 million during the year-earlier period, with revenue up about 2% from a year ago. The company’s Data Center segment showed significant growth, up 80% year-over-year to $2.3 billion, thanks to strong sales of its MI300 AI chip.

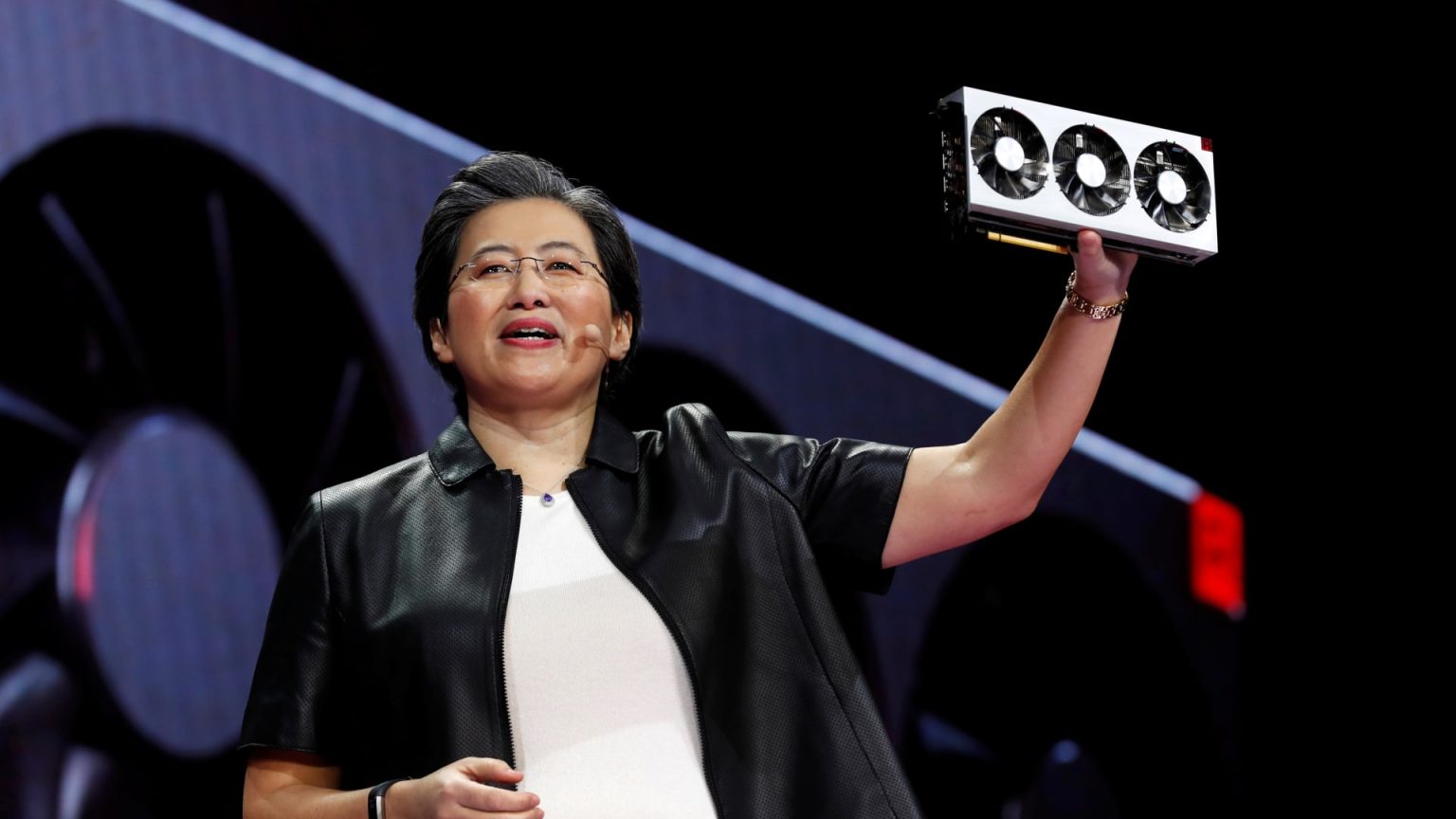

The MI300 AI chip competes with Nvidia’s AI graphics processors, with over $1 billion in sales since its launch in the fourth quarter of 2023. AMD officials are expected to provide an update on MI300 sales during an upcoming earnings call with analysts. However, AMD’s gaming segment experienced a decline of 48% annually to $922 million, attributed to lower chip sales for game consoles and PCs. This includes chips for Sony’s Playstation 5. AMD’s client segment revenue, which includes processors for chips and PCs, saw a significant increase of 85% annually to $1.4 billion, indicating that the PC slump from last year is over.

AMD is emphasizing its chips’ ability to run artificial intelligence programs locally, which could potentially power “AI PCs” and drive new laptop and desktop sales. The company’s embedded segment, acquired as part of the Xilinx acquisition in 2022, reported a decline in sales, dropping 46% annually to $846 million. Despite this, AMD remains focused on growth opportunities in both the data center and client segments. The company continues to innovate and expand its product offerings to meet the evolving needs of its customers, particularly in the AI and gaming sectors.

Overall, AMD’s performance for the first quarter exceeded expectations, demonstrating solid growth in key segments such as the Data Center and client segments. The company’s ability to adapt to changing market trends, such as the rise of AI applications, reflects its commitment to innovation and agility. It will be interesting to see how AMD leverages its strong product portfolio and strategic partnerships to capitalize on emerging opportunities in the technology sector. With a positive outlook for the current quarter and continued investments in key growth areas, AMD is well-positioned for future success in the competitive semiconductor market.