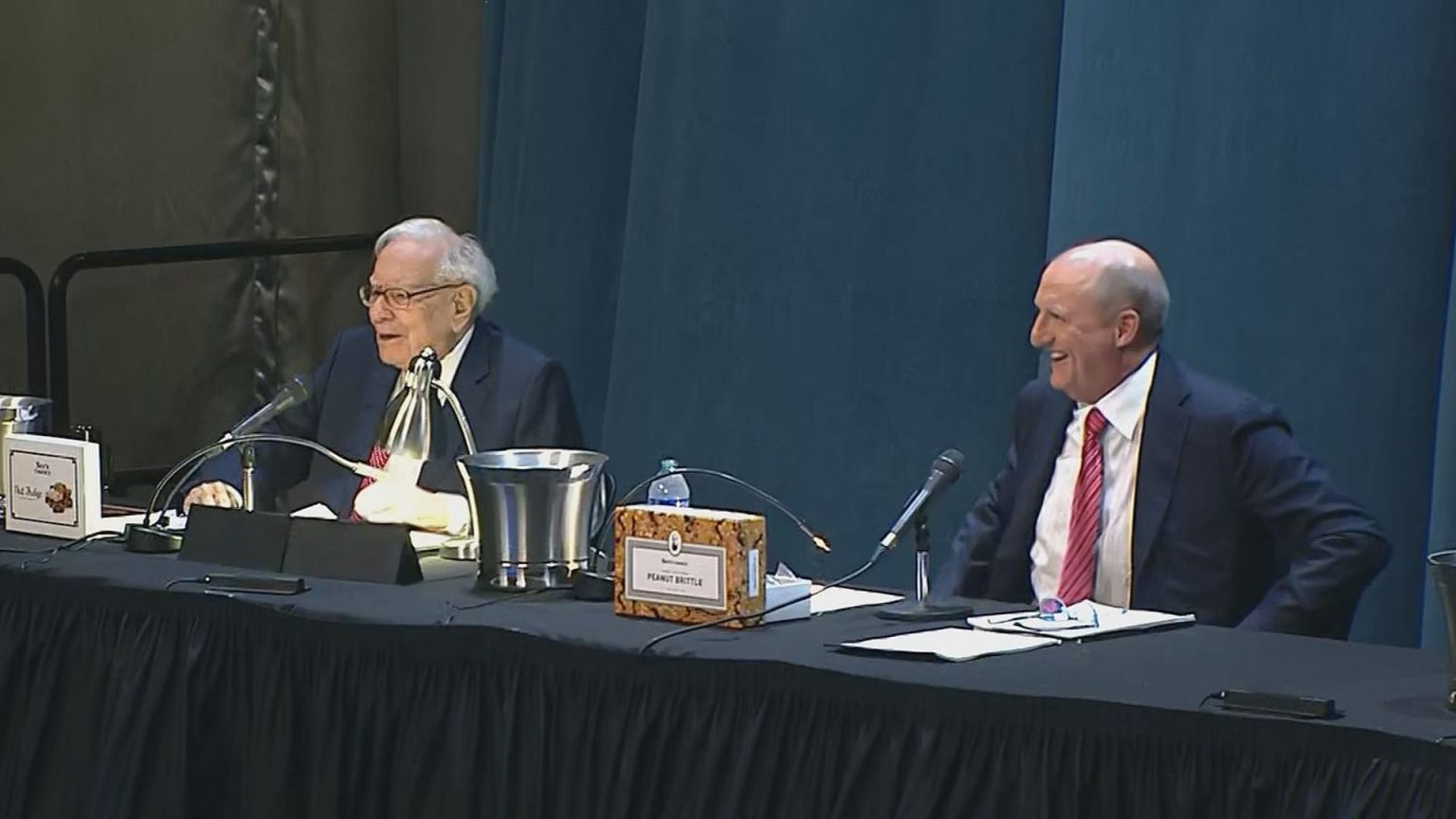

Warren Buffett announced at Berkshire Hathaway’s annual meeting that Greg Abel, his designated successor, will have the final say on investing decisions for the conglomerate once Buffett steps down. Abel, who has been overseeing a significant portion of Berkshire’s operations, including energy, railroad, and retail, was revealed as Buffett’s heir apparent in 2021 by Charlie Munger. Buffett clarified that the massive growth of Berkshire’s assets influenced his decision to entrust capital allocation to Abel, who has a deep understanding of businesses and common stocks.

As Berkshire’s cash pile swelled to nearly $189 billion and its equity portfolio reached $362 billion, Buffett emphasized the need for strategic thinking in managing such large sums. Given the size of the company’s investments, Buffett believes that the responsibility for capital allocation should rest solely with the CEO. Abel, with his expertise in the energy industry and experience leading Berkshire Hathaway Energy, is seen as well-equipped to handle this crucial aspect of the business. This includes decisions regarding stock picks, which were previously managed by Berkshire investment managers Todd Combs and Ted Weschler.

While Abel is set to take over as CEO, questions remained about who would control Berkshire’s public stock portfolio after Buffett’s departure. However, Buffett’s recent comments indicate that Abel will have the final say on all capital allocation decisions, including those related to the stock portfolio. Buffett emphasized the importance of having a chief executive who can make crucial decisions, such as acquiring businesses or stocks, when necessary. Abel’s track record in the energy sector and his experience with Berkshire Hathaway Energy position him as a suitable candidate for this role.

Buffett’s succession plan has been the subject of speculation for years, with investors curious about the roles of Berkshire’s top executives post-Buffett. The revelation that Abel will have the ultimate authority over investing decisions brings clarity to the situation and reflects Buffett’s trust in Abel’s abilities to lead the company forward. As Buffett nears his 94th birthday in August, the transition of leadership at Berkshire Hathaway is becoming increasingly imminent, and Buffett’s endorsement of Abel’s capabilities signals a smooth transition for the conglomerate.

Abel’s experience and expertise, particularly in the energy industry, make him a natural choice to succeed Buffett as Berkshire Hathaway’s CEO. His tenure at Berkshire Hathaway Energy, where he oversaw significant growth and operational success, has prepared him for the challenges of leading a diversified conglomerate like Berkshire. With Abel set to have the final say on capital allocation decisions, including investments in businesses and stocks, Berkshire shareholders can be reassured that the company’s future is in capable hands. Buffett’s endorsement of Abel as his successor signals a vote of confidence in Abel’s leadership abilities and strategic vision for the company’s continued success.