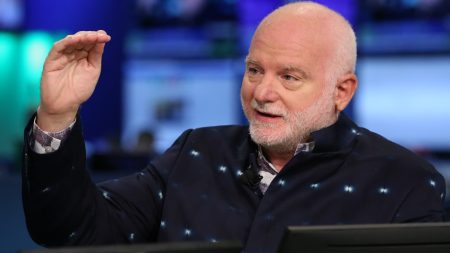

The CNBC Investing Club with Jim Cramer holds a “Morning Meeting” livestream every weekday at 10:20 a.m. ET. Wednesday’s meeting saw U.S. stocks edging lower after a three-session losing streak for the S & P 500, with increased volatility due to concerns about the Federal Reserve potentially keeping interest rates higher for longer and escalating tensions in the Middle East. Jim Cramer advised investors to focus on earnings rather than speculating about the central bank’s next policy move, emphasizing that company financials offer better indications of a stock’s future performance. The S & P 500 Short Range Oscillator indicated an oversold stock market, prompting the Club to look for buying opportunities in high-quality names. Cash was put to work on Wednesday by adding to the position in Abbott Laboratories following a post-earnings sell-off. Throughout the week, the Club also purchased shares of Best Buy, Constellation Brands, and Coterra Energy.

The Club saw positive results from its investments as both Morgan Stanley and Wells Fargo performed well. Morgan Stanley’s stock rose 1.5% on Wednesday, building on previous session gains fueled by largely better-than-expected quarterly results, including a significant rebound in investment banking. While Wells Fargo’s shares remained relatively flat following its upbeat earnings release last Friday, the Club expressed confidence in the bank’s strong fee-based revenues and its shift towards fee-based offerings under current management. Jim Cramer’s Charitable Trust is long on WFC, MS, ABT, BBY, CTRA, and STZ, according to the stocks listed. Subscribers to the CNBC Investing Club with Jim Cramer receive trade alerts prior to any trade being made. Jim typically waits 45 minutes after sending a trade alert before executing a trade in his charitable trust’s portfolio, and waits 72 hours after discussing a stock on CNBC TV before making a trade.

It is important to note that the information provided by the Investing Club is subject to their terms and conditions, privacy policy, and disclaimer. There is no fiduciary obligation or duty created by receiving information from the Investing Club, and no specific outcome or profit is guaranteed. The Club’s approach to investing involves a focus on earnings, buying high-quality names at a discount, and making strategic investment decisions based on company financials and market indicators such as the S & P 500 Short Range Oscillator. By following Jim Cramer’s advice and making informed investment choices, the Club has been able to generate positive results from its investment positions in companies such as Abbott Laboratories, Best Buy, Constellation Brands, Coterra Energy, Morgan Stanley, and Wells Fargo.

Overall, the CNBC Investing Club with Jim Cramer provides subscribers with valuable insights, trade alerts, and investment recommendations to help them navigate the stock market. By focusing on earnings and company financials rather than speculation on market events, the Club aims to make strategic investment decisions that lead to positive outcomes. The Club’s recent investments in companies like Abbott Laboratories, Best Buy, Constellation Brands, Coterra Energy, Morgan Stanley, and Wells Fargo have yielded positive results, with strong performances from several of these companies. Subscribers can benefit from Jim Cramer’s expertise and strategic approach to investing by following the Club’s trade alerts and making informed decisions based on the information provided.