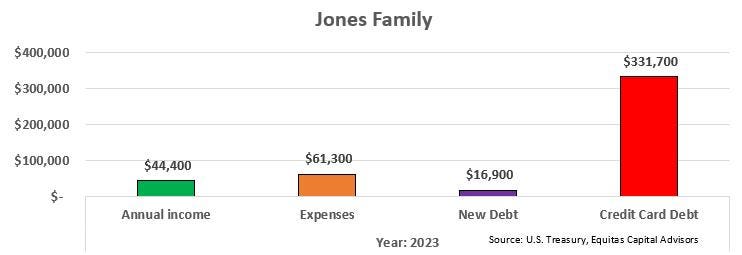

In 2010, a commentary called Federal Budget 101 was published to simplify the US budget by comparing it to a fictional family called the Jones family. Now, in a new article titled A Reverse Mortgage on the Country, the Jones family’s scenario has worsened over the years. The 2023 fiscal year federal budget is analyzed with numbers broken down to make them relatable, such as annual income, expenses, and new debt. The national debt has reached $33.17 trillion with a deficit spending ratio of 27.7%.

The Jones family has a staggering credit card debt equivalent to the national debt, which continues to increase each year. Despite not having a surplus since 2001, they do not address the growing debt issue. The debt exponentially increased by $231,800, almost 70% of their total debt. The government’s debt-to-GDP ratio has reached 120%, which experts suggest could have a negative impact on real growth levels if it surpasses 77%. The potential for inflation as a measure to combat debt could erode the purchasing power of consumers and corporations, posing challenges to economic stability and growth.

Interest rates play a crucial role in the federal government’s debt management. While the current average interest rate is 2.97%, the Jones family would face an annual interest payment of $75,462 with a 22.75% average APR. A soft landing with lower interest rates is anticipated by the market, but a different scenario could significantly increase the fiscal burden. The higher the interest rates, the costlier the debt becomes, emphasizing the need for fiscal responsibility.

Equitas Capital Advisors, established in 2002 in New Orleans, is closely monitoring the situation and stands ready to react if necessary. The company’s goal is to design, build, and deliver investment solutions to meet the goals and objectives of its investors. However, past performance may not guarantee future results, and all investment strategies have the potential for profit or loss. Asset allocation and diversification do not guarantee better performance and cannot eliminate investment risks.

Overall, the federal government’s debt situation is akin to a reverse mortgage on the country, drawing upon future resources to meet current demands. As the debt continues to increase, measures such as reducing federal spending or increasing revenue through taxes may be necessary to normalize debt levels. While lower interest rates could help narrow the deficit, more concerted efforts are required to ensure a smooth landing and prevent economic instability.