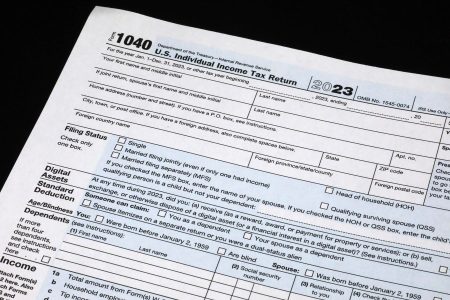

Taxpayers with investments in passive foreign investment companies (PFICs) often face complex and punitive tax rules, including paying taxes at high ordinary income rates and facing interest charges. Making certain elections, such as a qualified election fund (QEF) election, can help avoid these taxes and charges, but many taxpayers miss the deadline to make these elections. While retroactive QEF elections are possible in some instances, the process is difficult and expensive.

Recently, Treasury proposed a legislative fix to the retroactive QEF relief rules in its “Green Book” for the 2025 fiscal year. This proposal would give the IRS broader authority to allow taxpayers to make retroactive QEF elections, providing welcome relief to taxpayers with PFICs. The proposal’s progress in Congress is worth monitoring to see if it gains traction.

A foreign corporation is considered a PFIC if it earns 75% or more of its income from passive sources or holds 50% or more of its assets for passive income production, tests that are performed annually. Because there is no threshold stock ownership requirement for PFICs, U.S. taxpayers can easily own them, including popular investments like mutual funds and ETFs, leading to entanglement in the PFIC tax regime.

The PFIC tax rules were created by Congress to prevent U.S. taxpayers from deferring federal income taxes through foreign investments. When certain events trigger recognition, such as distributions or the sale of a PFIC, taxpayers must pay taxes at the highest applicable ordinary tax rates associated with their holding period, along with underpayment interest. Various elections exist to allow taxpayers to escape these default rules, such as the QEF election.

Currently, the QEF election must be made by the due date of the tax return, effective for the current and subsequent years. If the foreign corporation was a PFIC in prior years, taxpayers must comply with both PFIC and QEF taxation rules unless a “purging” election is made. Taxpayers who miss the deadline for the first tax year may qualify for retroactive relief through a private letter ruling request, a process that involves showing reliance on a tax professional and no prejudice to the government.

Treasury’s proposal in the Green Book aims to promote voluntary compliance and ease the substantial costs and resources associated with obtaining a PLR for retroactive relief. By amending section 1295(b)(2) to grant the IRS broader discretion in approving taxpayer requests for retroactive QEF relief, taxpayers could potentially receive relief by agreeing to pay all appropriate taxes as if they had made timely QEF elections. Until the proposal becomes law, taxpayers who missed timely QEF elections should consult with tax professionals on the best course of action.