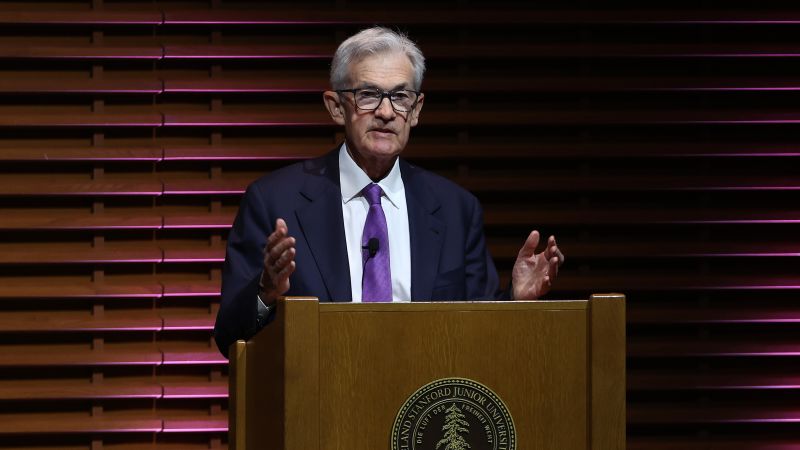

US stocks experienced some fluctuations on Tuesday following Federal Reserve Chair Jerome Powell’s statement that the central bank is unlikely to cut interest rates at its upcoming policy meeting, keeping rates higher for a longer period due to a lack of further progress on inflation. The Dow rose 0.2%, while the S&P 500 and Nasdaq Composite both saw slight declines. The 2-year Treasury yield briefly surpassed 5% before dropping back to around 4.96%.

Powell noted that recent data has not instilled greater confidence in reaching the central bank’s 2% inflation target, suggesting that it may take longer than expected to achieve that goal. Given the strength of the labor market and progress on inflation so far, Powell stated that restrictive policy needs more time to work and that decisions will be guided by evolving data and outlook. Interest rates are currently at a 23-year high as inflation remains a concern.

The recent retail sales report showed that consumer spending continued to be strong, indicating a solid economy and job market. This suggests that the Fed is not in a rush to cut rates, especially since there is no sign of a sharply deteriorating job market. While inflation pressures persist in services and housing, Powell’s comments align with other Fed officials’ statements, emphasizing the importance of not cutting rates at this time.

Rising gas prices and persistent increases in consumer prices have contributed to inflationary pressures, with the Personal Consumption Expenditures price index not providing much reassurance to Fed officials. Economic growth has been strong, potentially preventing inflation from declining further, while productivity growth may play a role in keeping inflation in check. The Atlanta Fed is projecting solid first-quarter GDP growth of 2.9%, suggesting a healthy economy.

While some analysts predict a rate cut later in the summer, others foresee the possibility of a cut in July. It remains uncertain how the Fed will communicate its rate decisions moving forward, particularly if inflation continues to be a concern. Various financial institutions are forecasting different timelines for a rate cut, with some expecting a cut in December. Fed Vice Chair Philip Jefferson expressed cautious optimism about inflation declining further and the labor market remaining strong. Stock levels may continue to fluctuate in response to economic developments.