The Department of Justice has recently announced the resurgence of an old investment scam known as the bank guarantee scam. The scam, operated by The Brittingham Group, led to the indictment, arrest, and sentencing of the individuals involved. John C. Nock, the ringleader, received a prison sentence of 20 years and 10 months, while other participants were also sentenced to lengthy prison terms. The Brittingham Group scammed investors out of over $18 million during its eight-year operation from 2013 to 2012.

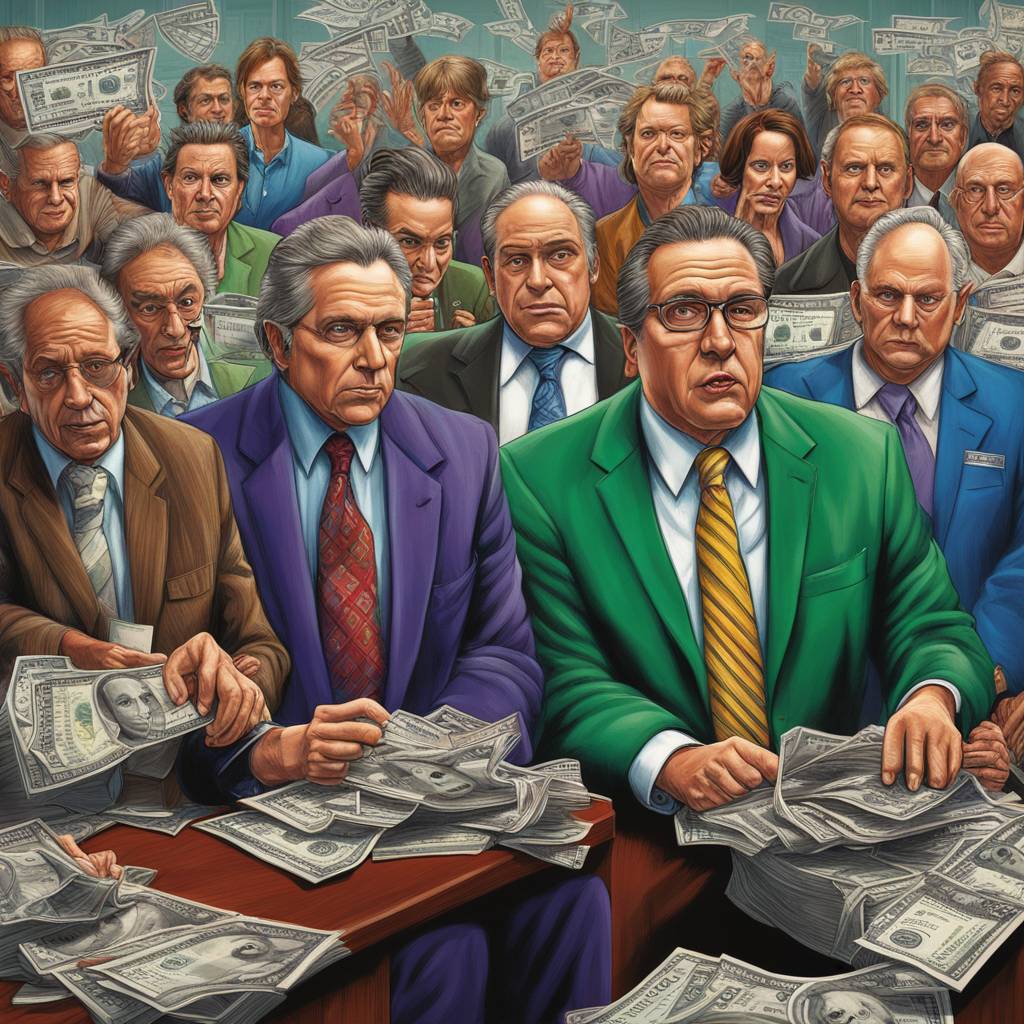

The bank guarantee scam is a subset of the High-Yield Interest Program scam, which is a type of Ponzi scheme. In this scam, fraud artists promise investors extremely high returns with the assurance that their investments are fully secured by major banks. The fraud artists typically forge documents from the banks to further deceive investors. Victims are lured into investing money with promises of exorbitant returns, only to later realize that they have been scammed when they cannot retrieve their funds from the bank.

A detailed indictment in the case of U.S. v. John Nock, et al., along with a civil Complaint in the case of Northwind Financial Corp. v. The Brittingham Group, sheds light on how the bank guarantee scam unfolded in real-life scenarios. Nock and Brittsan claimed to have connections with HSBC Bank and offered project financing services to companies in need. Using false representations and documents, they were able to scam multiple victims out of millions of dollars.

Victims of the scam were promised astronomical returns of 100% per week on their investments, leading them to wire substantial amounts of money to the Brittingham Group. The fraud artists, however, failed to deliver on their promises and instead concocted excuses for delays in payments, eventually embezzling the victims’ funds. The victims sought legal recourse by filing a Complaint in the U.S. District Court against the Brittingham Group and the individuals involved for various charges, including fraud, conspiracy, and breach of fiduciary duty.

To avoid falling victim to such scams, individuals should exercise caution and use common sense when presented with investment opportunities that seem too good to be true. Conducting due diligence on proposed investments, verifying the legitimacy of the investment and those promoting it, and seeking independent opinions are crucial steps in avoiding fraudulent schemes. Scams such as the bank guarantee scam thrive on the lack of due diligence by victims and their blind hope for financial gain, highlighting the importance of thorough research and skepticism in financial transactions.