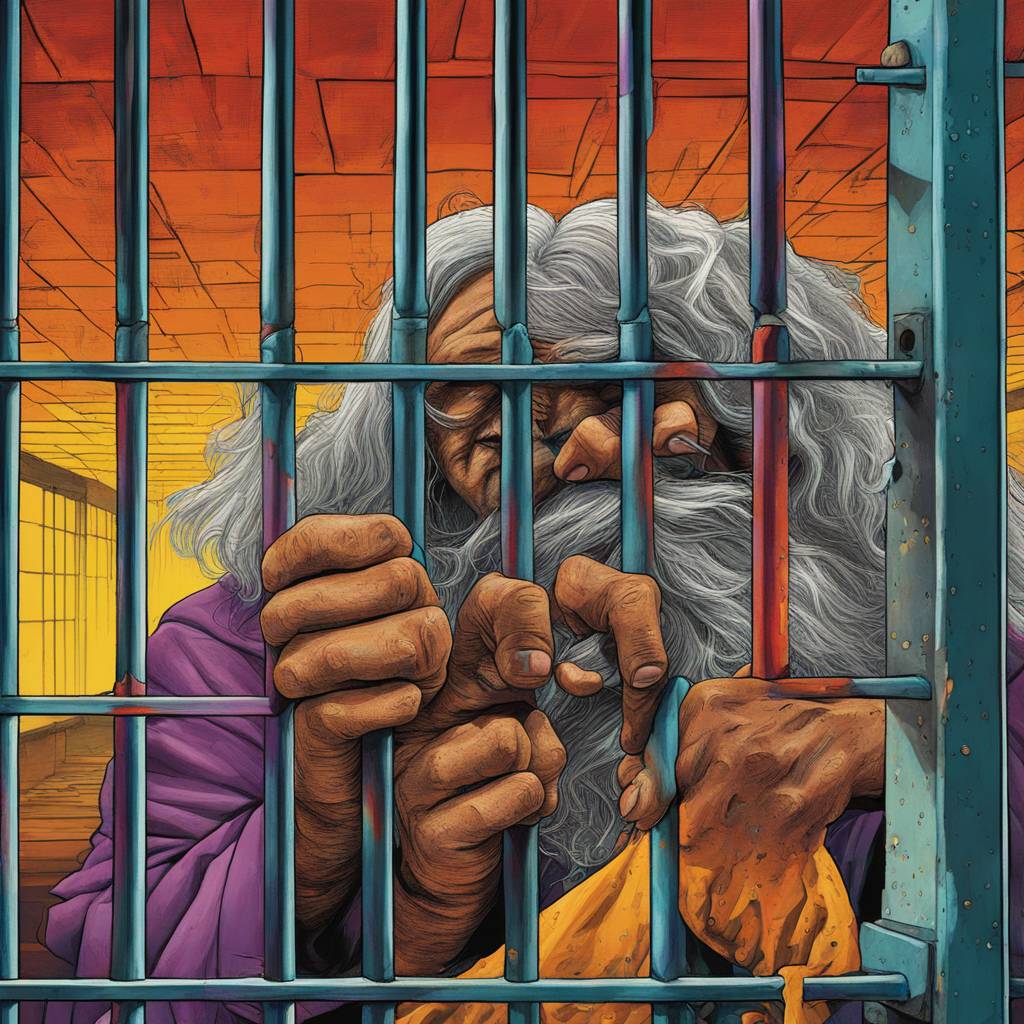

Former cryptocurrency mogul Sam Bankman-Fried was sentenced to 25 years in prison by Judge Lewis A. Kaplan after being convicted of seven counts of fraud, conspiracy, and money laundering. This marked the conclusion of a scandal that caused FTX, Bankman-Fried’s crypto exchange, to collapse, wiping out $8 billion in customer savings. Prosecutors had initially sought a sentence of 40 to 50 years, but the defense requested a much shorter term. Despite the sentence being less than the maximum possible penalty, it was still significant given the nature of the crimes committed.

Bankman-Fried, who was once a corporate titan and billionaire, apologized to FTX customers, investors, and employees before the sentencing. The downfall of FTX, which was valued at over $30 billion, happened in a matter of days in November 2022 when a run on deposits revealed a massive hole in the company’s accounts. Bankman-Fried resigned, and bankruptcy proceedings quickly followed. His subsequent arrest and charges of stealing from customers to finance various activities set off a swift and thorough investigation.

During his trial, Bankman-Fried’s associates testified against him, painting a picture of a scheme to loot customer accounts. Bankman-Fried himself appeared evasive on the stand, claiming memory lapses about key details of his time at FTX. The defense put forth arguments about his behavior possibly being due to autism and highlighted his charitable initiatives, casting FTX as a force for good. However, the prosecution vehemently rejected these claims, citing Bankman-Fried’s disregard for ethical and legal standards as evidence of his own megalomania.

The sentencing highlighted the devastation caused to FTX customers, with many experiencing severe financial losses that had a lasting impact on their lives. Victims described the collapse of FTX as a nightmare, with one individual sharing thoughts of suicide as a result of the situation. Despite assurances from Bankman-Fried’s defense that customers would be fully compensated through the bankruptcy process, the prosecution argued that this was misleading, as the payments would not account for the increase in crypto values post-collapse.

Bankman-Fried, who plans to appeal his conviction, seemed resigned to his fate during the sentencing. He acknowledged that his “useful life” was likely over and that he would spend a significant amount of time in prison. This marks a stark contrast to his previous status as a high-flying entrepreneur and philanthropist. The case serves as a cautionary tale about the dangers of hubris and unchecked greed in the cryptocurrency industry, highlighting the risks faced by investors and the potential fallout of fraudulent activities.