Nvidia’s shares surged over 10% after the company reported strong earnings that surpassed Wall Street expectations, driven by high demand for its artificial intelligence chips. Data center revenue experienced a significant 427% growth during the quarter. First-quarter revenue exceeded estimates at $26.04 billion, and the company anticipates $28 billion in revenue for the current quarter, surpassing analyst projections. The stock price hit an all-time high of $1,051.96, up 111% for the year, with analysts becoming increasingly bullish on the company’s future prospects.

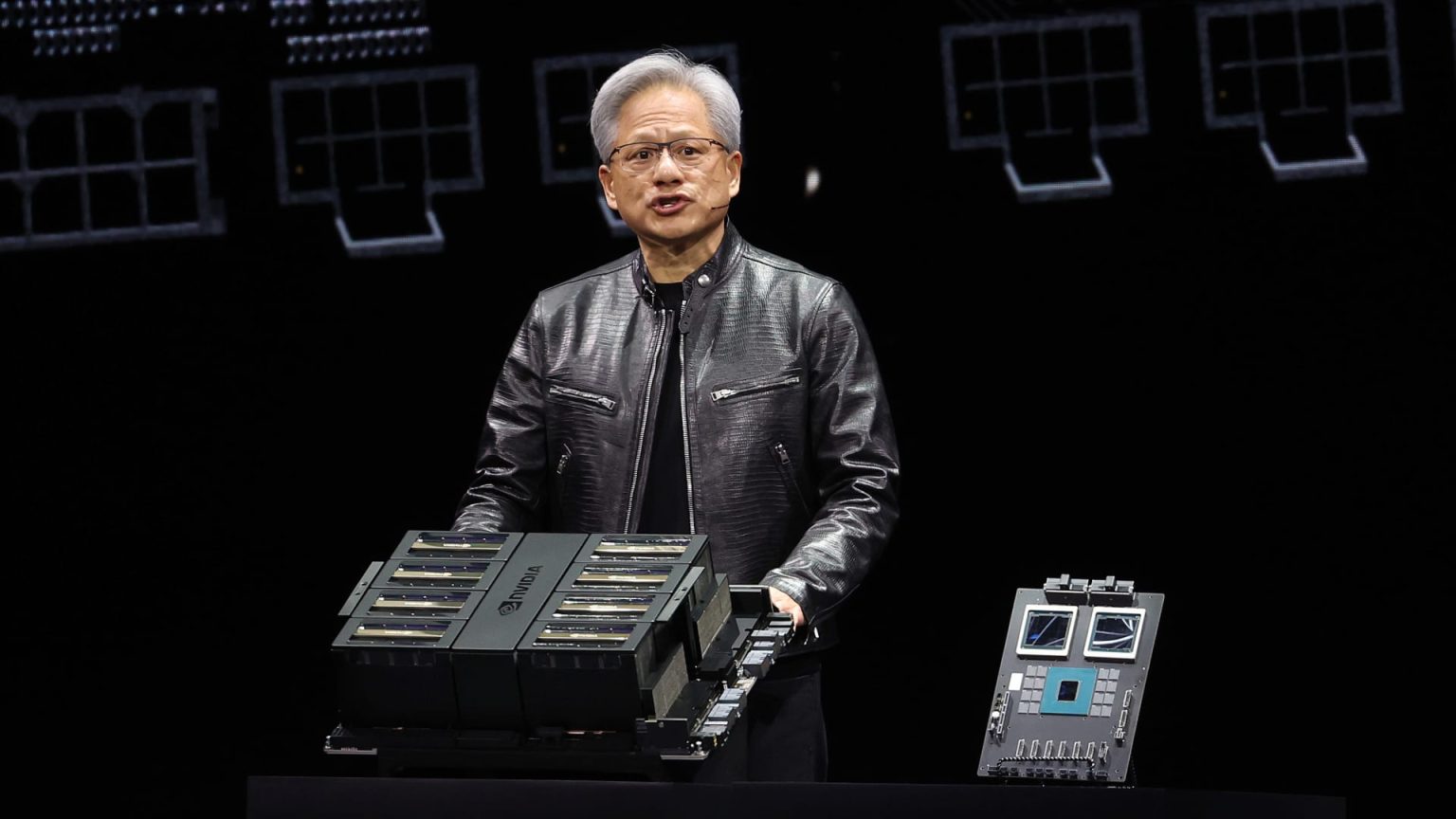

Despite concerns about a potential market downturn, analysts remain optimistic about Nvidia’s future performance. Bernstein raised its price target to $1,300, citing the ongoing growth narrative surrounding the company. Jefferies also raised its target to $1,350, attributing the increase to the strong adoption of Nvidia’s new AI graphics processors, named Blackwell. The company’s net income jumped to $14.88 billion, or $5.98 per share, a significant increase from the previous year’s $2.04 billion, or 82 cents per share.

Nvidia’s announcement of a 10-for-1 stock split further buoyed investor sentiment, with shares set to start trading on a split-adjusted basis on June 10. The split is expected to make the stock more accessible to investors and potentially attract more retail interest. The company’s strong financial performance and bullish guidance indicate a positive outlook for Nvidia’s growth trajectory and potential for further share price appreciation.

The surge in Nvidia’s stock price reflects the continued demand for its AI chips and data center products, driving revenue growth and exceeding analyst expectations. The company’s strong financial results and optimistic guidance have reinforced investor confidence in Nvidia’s ability to capitalize on the growing market for artificial intelligence and graphics processing units. The stock split announcement also signals management’s confidence in the company’s future growth prospects and commitment to enhancing shareholder value.

Nvidia’s dominance in the AI and data center markets, as well as its innovative products like Blackwell, have positioned the company for continued success and future growth. The stock split and positive analyst outlook further underline Nvidia’s potential for long-term value creation and sustained market leadership in the semiconductor industry. Investors are optimistic about the company’s ability to maintain its upward trajectory and capitalize on the increasing demand for AI technologies across various industries.