On a recent Friday, Nvidia shares took a hit, dropping by 10%, marking the worst trading day for the chipmaker since March 2020. Despite this alarming plunge, there was no specific news catalyst behind the drop. Additionally, Super Micro Computer, a vendor that constructs Nvidia-based servers, saw its shares plummet by 23% on the same day. The company’s decision to deviate from its usual practice of providing preliminary results seemed to contribute to the market’s negative reaction. However, Super Micro had previously raised its sales and earnings guidance just 11 days before unveiling its second-quarter financial results in January. The company is set to report its fiscal third-quarter results on April 30.

Both Super Micro and Nvidia were the poorest performers in the S&P 500 on the aforementioned trading day. While Super Micro was newly added to the index in March, it has experienced a surge in sales due to the increasing demand for Nvidia-based computers that are instrumental in the development of artificial intelligence programs like ChatGPT. Furthermore, investors showed skepticism towards several semiconductor stocks in anticipation of upcoming earnings announcements. The VanEck Semiconductor Index, which focuses on chip-related companies, declined by 4.5%, while Arm, a provider of chip intellectual property complementary to Nvidia’s GPU servers, saw its shares drop by 17%. Even AMD, Nvidia’s main GPU rival, experienced a 5% decrease in its stock value.

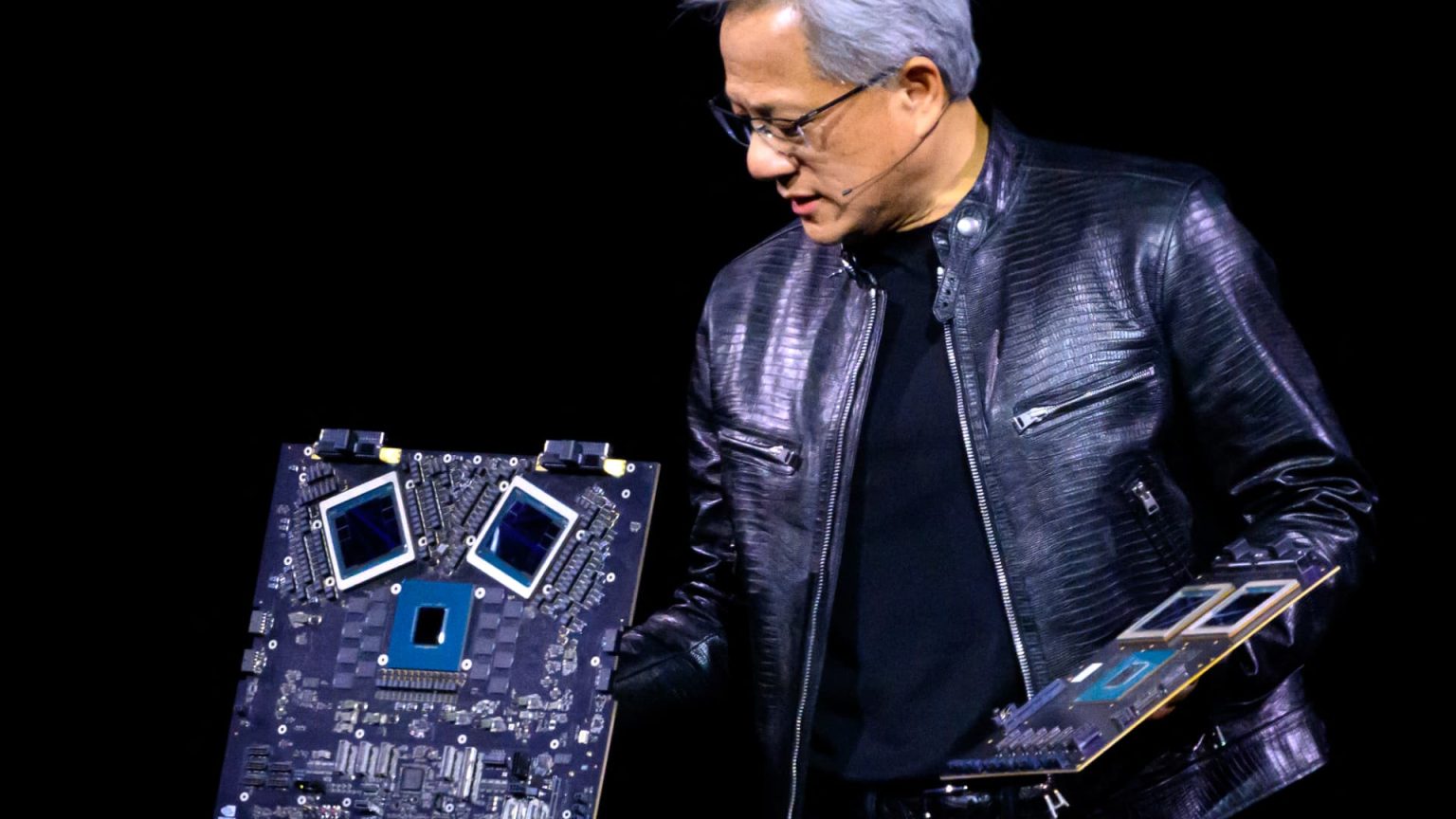

Despite the significant drop in its stock price, Super Micro’s shares have still risen by around 151% since the beginning of the year, following a remarkable 246% increase in 2023. This significant growth demonstrates the company’s strong performance and investor confidence, even in the face of occasional setbacks. Conversely, Nvidia’s shares have recorded a more modest 58% increase thus far in 2024. The competition in the market remains fierce, with companies like Dell and Hewlett Packard Enterprise getting ready to introduce systems utilizing Nvidia’s latest Blackwell graphics processing units. This intensifying rivalry underscores the importance of innovation and strategic partnerships in the rapidly evolving semiconductor industry.

Overall, the volatility in the stock market observed on the aforementioned Friday underscores the unpredictability of the tech sector, where even successful companies like Nvidia and Super Micro can experience significant fluctuations in their stock prices. The interdependence between different players within the semiconductor ecosystem also highlights the ripple effects that occur when one company’s performance or announcement impacts others. As investors await further updates and earnings reports from key players in the industry, it remains to be seen how these developments will shape the future trajectory of these companies and the semiconductor market as a whole.