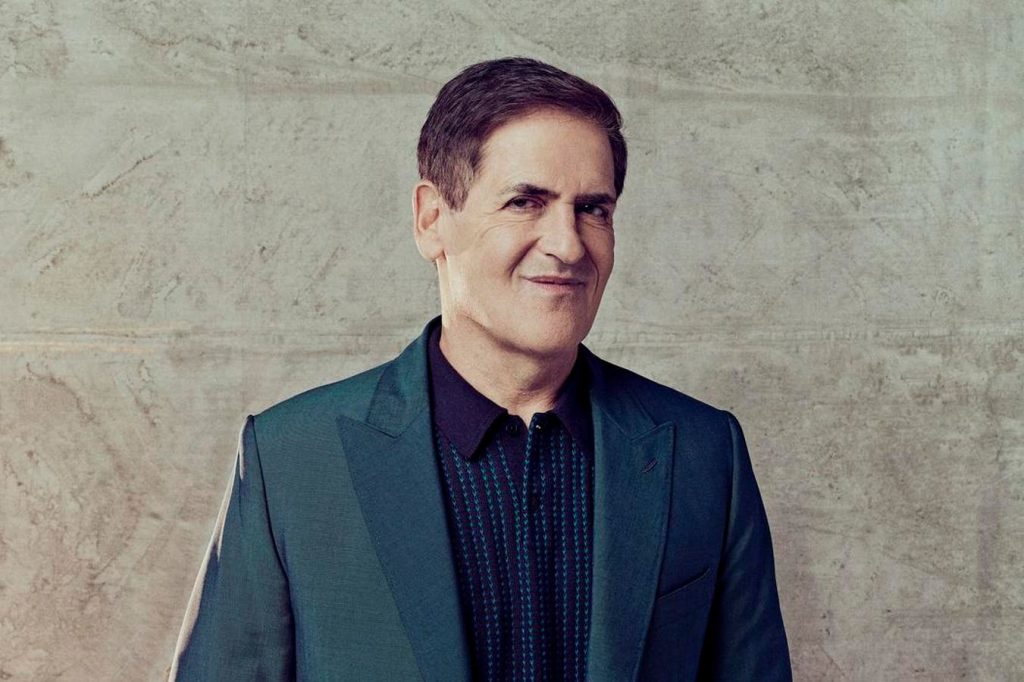

Billionaire Mark Cuban proudly shared on social media that he paid an astonishing $275.9 million in taxes to the IRS. Despite the massive sum, Cuban stated that paying taxes is a patriotic duty and a way to give back to the country after military service. This tax bill is significantly larger than usual for Cuban, who typically pays varying amounts each year. The substantial increase is likely due to the sale of a majority stake in the Dallas Mavericks, which resulted in a pre-tax windfall of $1.75 billion.

The sale of the Dallas Mavericks accounted for Cuban’s significant tax bill, which also includes other sources of income. The complex nature of sports team sales can lead to deductions and adjustments that affect the final tax amount. A tax expert explained that Cuban may have been able to offset the gains from the sale with potential operating losses or previous losses carried forward. Additionally, the Mavericks sale may have been executed in installments, further influencing the tax implications. Cuban himself acknowledged being strategic with his taxes, sharing various ways he reduces tax liability, such as investing in opportunity zones and tax-free bonds.

Cuban’s sentiments about taxation have not always been positive, as he once expressed feeling financially at risk due to potential tax law changes, like Senator Elizabeth Warren’s proposed billionaire tax on unrealized gains. Despite this, Cuban remains committed to paying his taxes and views it as a responsibility of wealth. The billionaire emphasized the benefits of being rich and the importance of contributing to society through taxes. While some billionaires have expressed reluctance to pay taxes, Cuban stands out for his outspoken support for taxation and the positive impact it can have.

In a typical year, Cuban’s fortune is primarily tied to his ownership stake in the Mavericks and various investments. However, the sale of a significant portion of the team resulted in the sizable tax bill, which showcases the complexities of high-income tax calculations. Cuban’s tax-savvy strategies, such as investing in tax-efficient opportunities and utilizing deductions, have helped him navigate the tax landscape effectively. Despite facing potential tax challenges, Cuban remains dedicated to fulfilling his tax obligations and recognizes the benefits it brings to the country.

Mark Cuban’s public declaration of his massive tax payment highlights his unique perspective on taxation as a form of patriotism and social responsibility. His willingness to share details about his tax bill and strategies sheds light on the complexities of managing significant wealth and navigating tax obligations. Cuban’s proactive approach to tax planning and his commitment to fulfilling his tax obligations demonstrate a conscientious attitude towards contributing to society and supporting the country through tax payments. Ultimately, Cuban’s stance on paying taxes serves as a reminder of the importance of financial responsibility and the positive impact taxation can have on society as a whole.