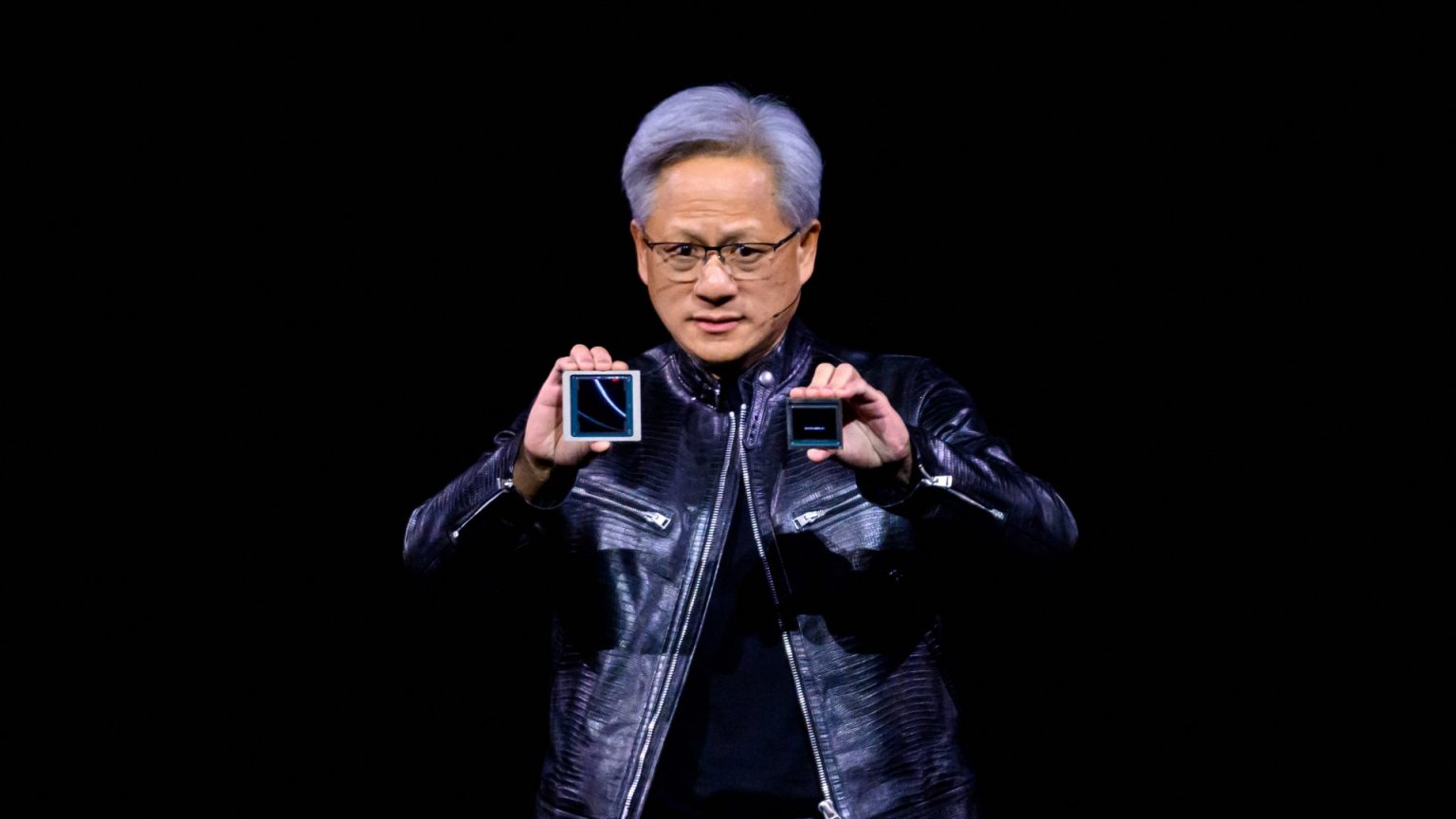

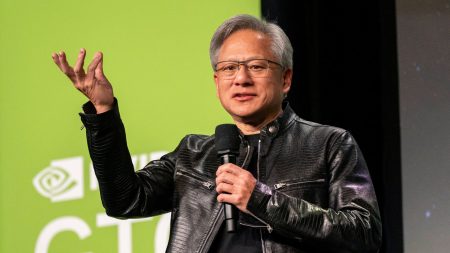

First, it is important to note that chasing big rallies in stocks, especially one as large as Nvidia, is not recommended. Nvidia’s market cap gained $250 billion Thursday to more than $2.62 trillion, making it a risky time to buy at such high levels. The Club had a 2 rating on Nvidia’s shares before the earnings release, and they maintain that rating, advising investors to wait for a pullback before considering buying. For the Club portfolio, they would need to see a sizeable dip to consider adding to their own position. With a cost basis of nearly $156 per share and a price target of $1,200, Nvidia is considered an “own it don’t trade it” stock for the Club.

Second, while the Club may not be looking to buy Nvidia at current levels, for investors who have no shares or have a small position with a higher cost basis, it may be a better time to consider buying. The Investing Club encourages members to be educated investors, take control of their financial decisions, and develop their own disciplines. When considering a stock like Nvidia, especially for long-term investors, it is important to look beyond a 12-month time horizon and think about what the world will look like in 10 years. Nvidia’s position in the high-performance graphic processing units market, along with their potential in the AI revolution, makes it a compelling stock for long-term growth.

Third, Nvidia’s success is not solely based on earnings estimates for a 12-month period, but on its potential to disrupt multiple industries and make significant advancements in technology. With generative AI at the forefront, Nvidia is poised to be a key player in autonomous vehicles, drug discovery, enhanced cybersecurity, and other areas. The stock’s current multiple of about 40 times forward earnings is in line with its five-year historical average, suggesting that despite the recent rally, the stock may still have room for growth. Pullbacks are expected, but the fundamental earnings growth of Nvidia is a driving force behind its valuation.

Fourth, CFO Colette Kress provided insights into Nvidia’s growth potential in the automotive market, with expectations for it to be the largest enterprise vertical within the data center. This, along with growth in other verticals like health care and sovereign AI initiatives, points to a promising future for Nvidia’s revenue streams. The company’s broad technology stack for deploying and running generative AI inference on PCs further underscores its position as a leader in the technology sector. As Nvidia continues to innovate and expand its offerings, there is potential for continued growth and success in the years ahead.

Fifth, for investors looking to buy Nvidia after its recent surge, it is important to consider the long-term outlook for the company and not focus solely on short-term gains. With the potential for continued advancements in generative AI and its impact on various industries, Nvidia’s role in shaping the future of technology is significant. Taking a step back and considering the broader impact of Nvidia’s technology beyond traditional earnings estimates can provide a more holistic view of the company’s growth potential. By understanding the long-term trends and opportunities in the market, investors can make informed decisions about investing in Nvidia.

In conclusion, Nvidia’s recent surge to record highs highlights the company’s strong performance and potential for growth in the future. While the stock may be trading at high levels, there is still room for growth given its position in the AI revolution and other technology advancements. By taking a long-term perspective and considering Nvidia’s role in shaping the future of technology, investors can make informed decisions about buying and holding the stock. As Nvidia continues to innovate and expand its offerings, its potential for continued success remains high, making it a compelling investment opportunity for those looking to participate in the growth of the technology sector.