In addition to the stock’s proximity to a historically bullish trendline and the potential for a rebound based on past performance, options for DKNG are currently priced at affordable levels. The Schaeffer’s Volatility Index (SVI) for the stock is at 38%, ranking in the low 3rd percentile of its annual range. This indicates that options traders are expecting low levels of volatility in the near future.

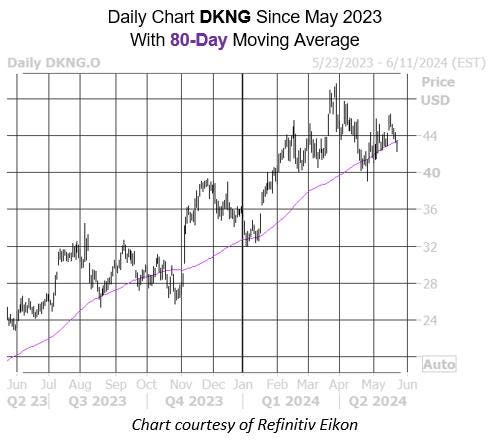

Despite recent losses and a post-earnings bear gap in early May, DraftKings (DKNG) has shown resilience and is currently trading at $42.42. The stock has been on a downward trend in the last five days, but is still near a historically bullish trendline. The stock has also come within one standard deviation of its 80-day moving average, trading above this trendline 80% of the time in the past two months and in eight of the past 10 trading days.

Looking at past instances where DKNG has come within one standard deviation of its 80-day moving average, the stock has been higher one month later for three out of four instances, with an average return of 8.9%. A similar move in the current situation could potentially put the shares back above breakeven for the quarter and continue the pattern of higher highs seen in the last 12 months.

Investors may see the current pullback in DKNG as an opportunity to enter the stock at a more affordable price, especially considering the potential for a rebound based on historical trends. Options for the stock are currently priced at low levels of volatility, which could make them an attractive choice for traders looking to take advantage of potential price movements in the stock.

Overall, while DKNG has experienced some volatility and losses in recent days, the stock is still near a historically bullish trendline and has shown potential for a rebound based on past performance. Options for DKNG are also currently priced at affordable levels, with low volatility expectations from traders. Investors may see the current situation as an opportunity to enter the stock at a more favorable price and potentially benefit from a future uptick in the stock price.