Intel’s long-awaited turnaround seems to be further away than ever based on the company’s dismal first-quarter earnings report. Despite no longer experiencing a decline in revenue and still being a major player in providing processors for PCs and laptops, Intel’s first-quarter sales fell short of estimates, and the company’s forecast for the second quarter indicates weak demand. CEO Pat Gelsinger, who took the helm in 2021, faced a tough showing as Intel’s problems have been decades in the making, losing ground to overseas competitors like Taiwan Semiconductor Manufacturing Co.

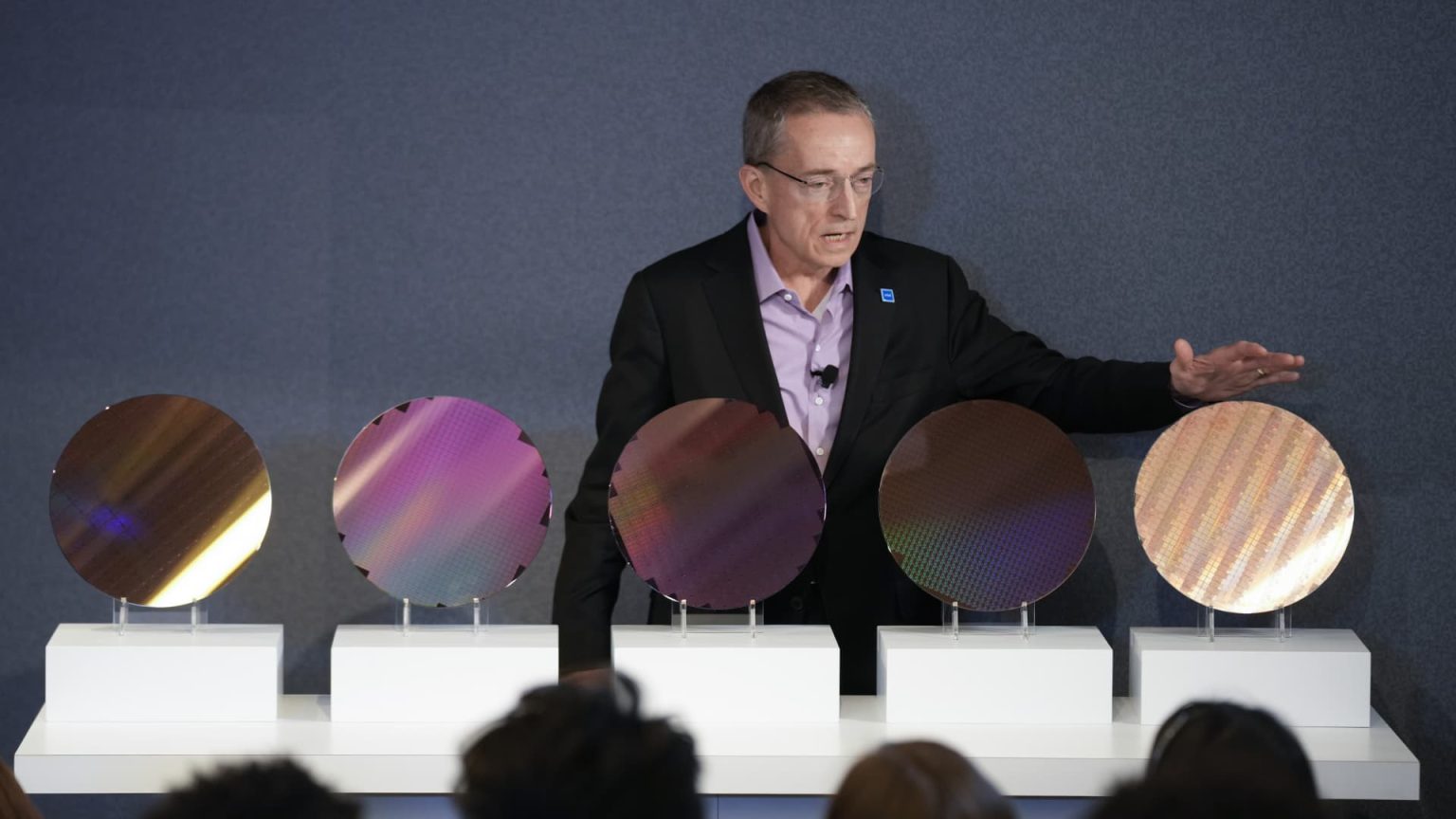

Intel is facing an uphill battle to close the technology gap that has emerged due to years of underinvestment. The company is spending billions each quarter in a high-risk effort to catch up with rivals. This turnaround effort includes a risky business model change where Intel will not only manufacture its own branded processors but will also act as a factory for other chip companies that outsource their manufacturing. This strategic move hinges on Intel regaining “process leadership” in semiconductor manufacturing to attract customers like Nvidia, Apple, and Qualcomm.

Despite being viewed as an American chip champion, Intel faces skepticism from investors as it has become the worst-performing tech stock in the S&P 500 this year. The company’s market share has dwindled compared to rivals like Nvidia, Qualcomm, Broadcom, and AMD. Intel’s decline can be traced back to missed opportunities, such as failing to capitalize on the mobile chip boom initiated by Apple’s iPhone and being left on the sidelines of the AI revolution, which has propelled companies like Nvidia to success.

Intel’s struggles have been exacerbated by its failure to keep up with the shrinking of transistors on chips. Semiconductor companies rely on shrinking transistors to increase processing power, but Intel’s delays in transitioning to new process nodes have allowed competitors like AMD to surpass them in certain areas. The rise of AI and the demand for powerful GPUs have further challenged Intel, as companies prefer Nvidia’s GPU-based servers for AI applications, leaving Intel struggling to compete in this growing market segment.

Intel’s efforts to catch up by expanding its manufacturing capabilities have come at a hefty cost, with billions in losses in the foundry division. The company aims to regain its leadership in transistor size by 2026 but faces challenges in attracting external companies to use its fabs. Despite early signs of progress in rebuilding customer trust and demand for upcoming server chips made using Intel’s advanced processes, the road to recovery remains long and uncertain for the once-dominant chipmaker.

Overall, Intel’s journey to reinvention and relevance in the semiconductor industry is fraught with challenges. The company is betting big on closing the technology gap, attracting external chip companies to its foundries, and regaining its place as a leader in semiconductor manufacturing. However, the road ahead is uncertain, and Intel will need to overcome its past failures, competition from rivals, and skepticism from investors to truly turn the tide and reclaim its position as a key player in the tech industry.