If you haven’t filed your taxes yet this year, the deadline to do so is April 15th. If you received freelance income through payment apps like PayPal, Venmo, Cash App, or Zelle, you may be unsure about how the 1099-K changes will impact your tax return. The IRS had planned to implement a new reporting rule requiring these apps to report income over $600 to the agency, but this has been delayed for this tax season. This delay gives payment platforms more time to prepare for the implementation of the new reporting requirements.

The reporting requirement for third-party payment apps to report earnings over $600 to the IRS was originally set to begin in 2022 but has been delayed for two years in a row now. The distinction between taxable and nontaxable transactions through these apps complicates the implementation of this rule. For example, money received for personal expenses like dinner with a roommate is not taxable, while income from a freelance project is. The delay allows the payment platforms to gather feedback and prepare effectively for the reporting changes.

For the 2024 tax year, the IRS plans to roll out a phased implementation of reporting requirements, starting with earnings over $5,000 instead of $600. This higher threshold aims to reduce inaccuracies and give the agency and payment apps more time to adjust to the eventual $600 minimum requirement. If you’re self-employed, you should already be paying taxes on your total income, even if you don’t receive a 1099 for all your earnings. The reporting requirement shift will help the IRS monitor transactions that often go unreported.

In the meantime, for the 2023 tax year, the reporting requirement has been paused. This means if you earn freelance income, you’ll report your earnings as usual without receiving a 1099-K form from payment apps unless your earnings exceed $20,000 across 200 transactions. It’s important to understand that even without a tax form from a client, you are responsible for reporting all self-employment income. For the 2024 tax year, you will receive a 1099-K if you earn over $5,000 from a freelance client through payment apps like PayPal, Venmo, Zelle, Cash App, Upwork, or Fivver.

It’s crucial to keep track of your earnings and transactions to ensure accurate reporting. Personal transactions, such as gifts, reimbursements, or splitting expenses, are not taxable and will not be reported on a 1099-K. If you sell personal items at a loss, you won’t owe taxes on the sale. However, if you have a side hustle where you sell items for a profit, these earnings may be taxable and reported to the IRS. Make sure to maintain good records of your purchases and sales to avoid errors in reporting taxable income.

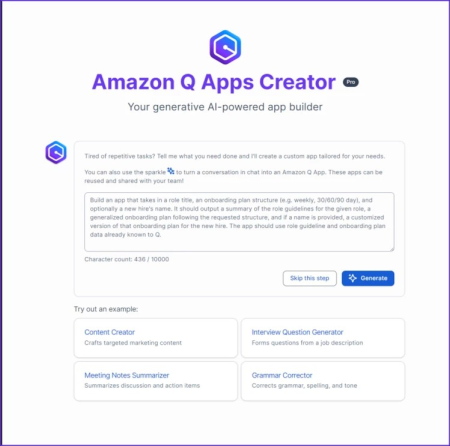

To prepare for the reporting change, payment apps may ask for tax information like your EIN, ITIN, or SSN. Keeping track of your earnings and expenses, manually or with accounting software, can help you navigate the new reporting requirements smoothly. If you receive payments from multiple clients through payment apps and earn over $5,000, you’ll receive one 1099-K form instead of multiple 1099-NECs. By staying organized and informed, you can ensure a hassle-free tax filing experience when reporting self-employment income through third-party payment apps.