The International Monetary Fund predicts that the US economy will be a major driver of global growth this year, with a forecasted growth rate of 2.7%, higher than previously predicted. In contrast, the European economy is expected to struggle due to high interest rates and previous rises in energy costs. The global economy as a whole is expected to expand by 3.2%, with China’s economy growing by 4.6% and India’s by 6.8%. The strong performance of the US economy has been attributed to robust productivity and employment growth, as well as strong demand, leading to cautious recommendations for monetary easing by the Federal Reserve.

The US economy has already surpassed its pre-pandemic growth trend, which could lead to overheating and rising inflation. Annual US inflation has recently increased following a period of decrease, prompting traders to postpone expectations of a Fed interest rate cut. There are concerns that the Fed may instead resume raising rates by early next year, given the risks posed by high government spending and debt levels in the US. In contrast, there is little evidence of overheating in the euro area, with the European Central Bank needing to carefully calibrate monetary easing to avoid falling below its 2% inflation target.

Globally, inflation is expected to average 5.9% this year, down from 6.8% in 2023 but slightly above previous forecasts. Progress toward inflation targets has stalled since the beginning of the year, despite lower energy costs and supply chain improvements tempering price increases. Stubbornly high service costs and rising oil prices present risks of pushing overall prices higher again. Additional trade restrictions on Chinese exports could further impact global inflation, with concerns about potential dumping by China leading to the possibility of tariffs on Chinese products.

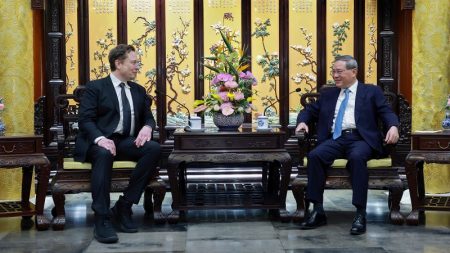

China’s economic growth poses as a source of risk to global inflation, with a higher-than-expected expansion rate in the first quarter leading to support for oil prices. Strong economic growth in China, coupled with escalating tensions in the Middle East and potential trade restrictions, could contribute to higher inflation levels globally. The IMF warns of the need for careful monitoring of inflation in various regions, with strategies to address potential risks and maintain stability in the face of economic uncertainties. Overall, the performance of key economies, such as the US and China, will significantly influence global growth and inflation dynamics in the coming year.