Investors in the K-pop sector have had a challenging start to the year due to lower fourth-quarter sales and profits, as well as dating scandals impacting stock prices. The “big four” K-pop companies, including JYP Entertainment, SM Entertainment, YG Entertainment, and Hybe, have all seen declines in their stock prices since the beginning of the year. The decline in SM Entertainment’s stock was fueled by a dating scandal involving one of the agency’s artists, Karina, from the girl group Aespa.

Despite the challenges faced by the K-pop sector, Goldman Sachs expressed optimism for the industry in a March 14 report, stating that the sector is “misunderstood.” The investment firm sees a “high potential for valuation re-rating” for the companies, as they continue to deliver multi-year earnings growth. For 2023, all four companies posted higher full-year revenue and net profits, indicating a positive outlook for the industry.

Goldman Sachs highlighted that the sell-off in the K-pop sector is tied to markets focusing on album sales as a key metric for measuring the number of fans. The analysts argued that offline concert audience is actually the superior metric for measuring the growing reach of K-pop, as album sales can be skewed by wallet share and pandemic-related distortions. The firm believes that the growth in the K-pop industry has not stopped scaling at a rapid pace, particularly in terms of in-person concert attendance.

Japan is seen as a key growth driver for the K-pop industry in the near term, with substantial fanbase growth opportunities being overlooked by the market. The analysts noted that Japan has historically been one of the largest overseas fanbases for K-pop, and recent developments in the country have created favorable conditions for K-pop artists. The growth potential in Japan includes increased concert audiences and opportunities for K-pop companies to expand their market share in the region.

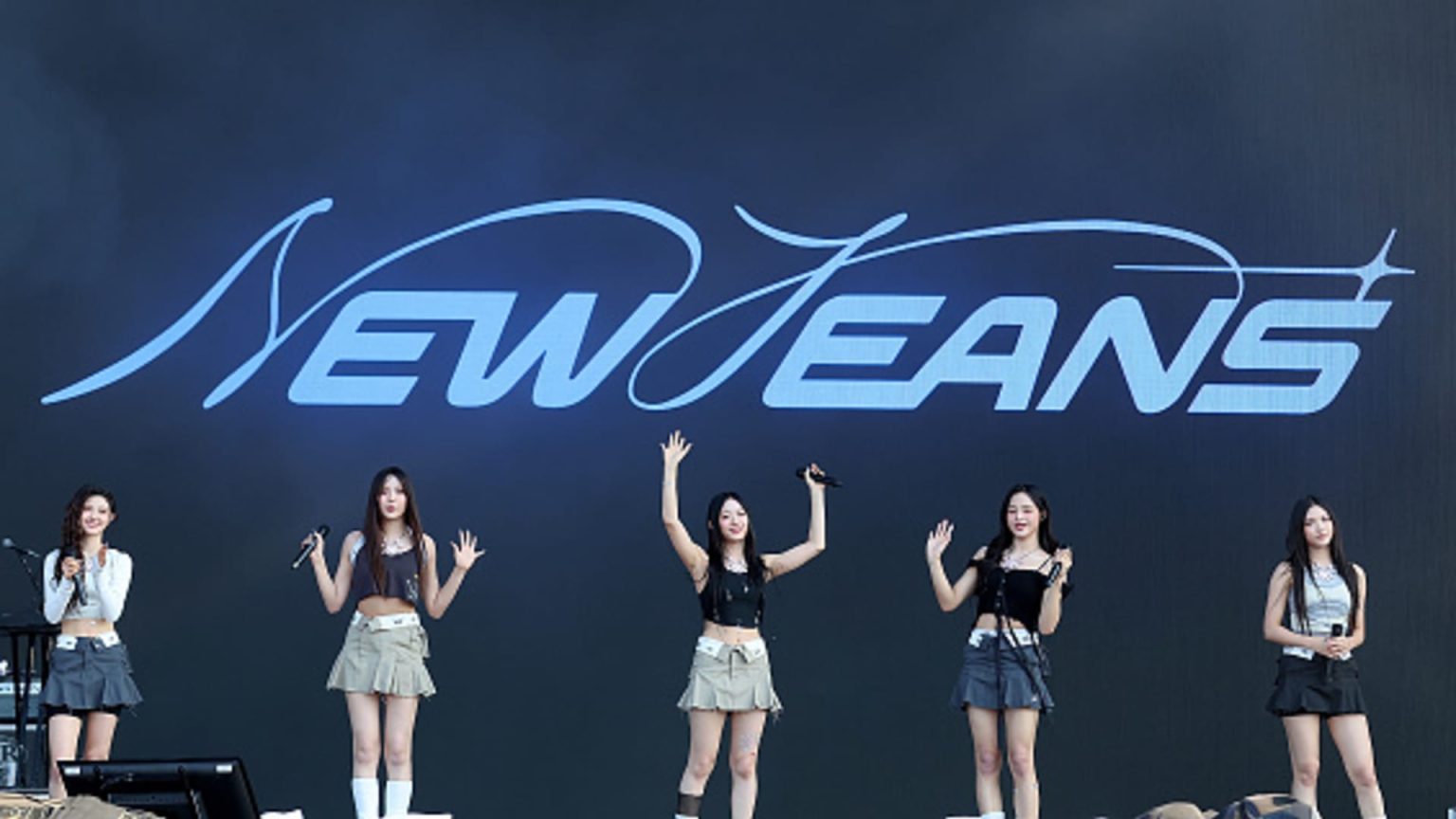

Goldman also emphasized the global fanbase growth of K-pop, particularly in markets like the U.S. The success of Hybe-managed girl group NewJeans on U.S. charts was highlighted, with the group achieving No. 1 on the U.S. Billboard 200 and performing at Lollapalooza. Le Sserafim, managed by Hybe subsidiary Source Music, also made their debut at the Coachella music festival, showcasing the increasing global appeal of K-pop. Hybe’s expanded partnership with Universal Music Group further solidifies K-pop’s mainstream presence globally.

In conclusion, Goldman Sachs sees a long runway of growth ahead for the K-pop sector, with continued opportunities for expansion and increased global reach. The firm believes that further downside for wallet share, which has normalized close to pre-Covid levels, is limited. Overall, the analysts are bullish on the industry’s prospects and anticipate a positive trajectory for K-pop companies in the coming years.