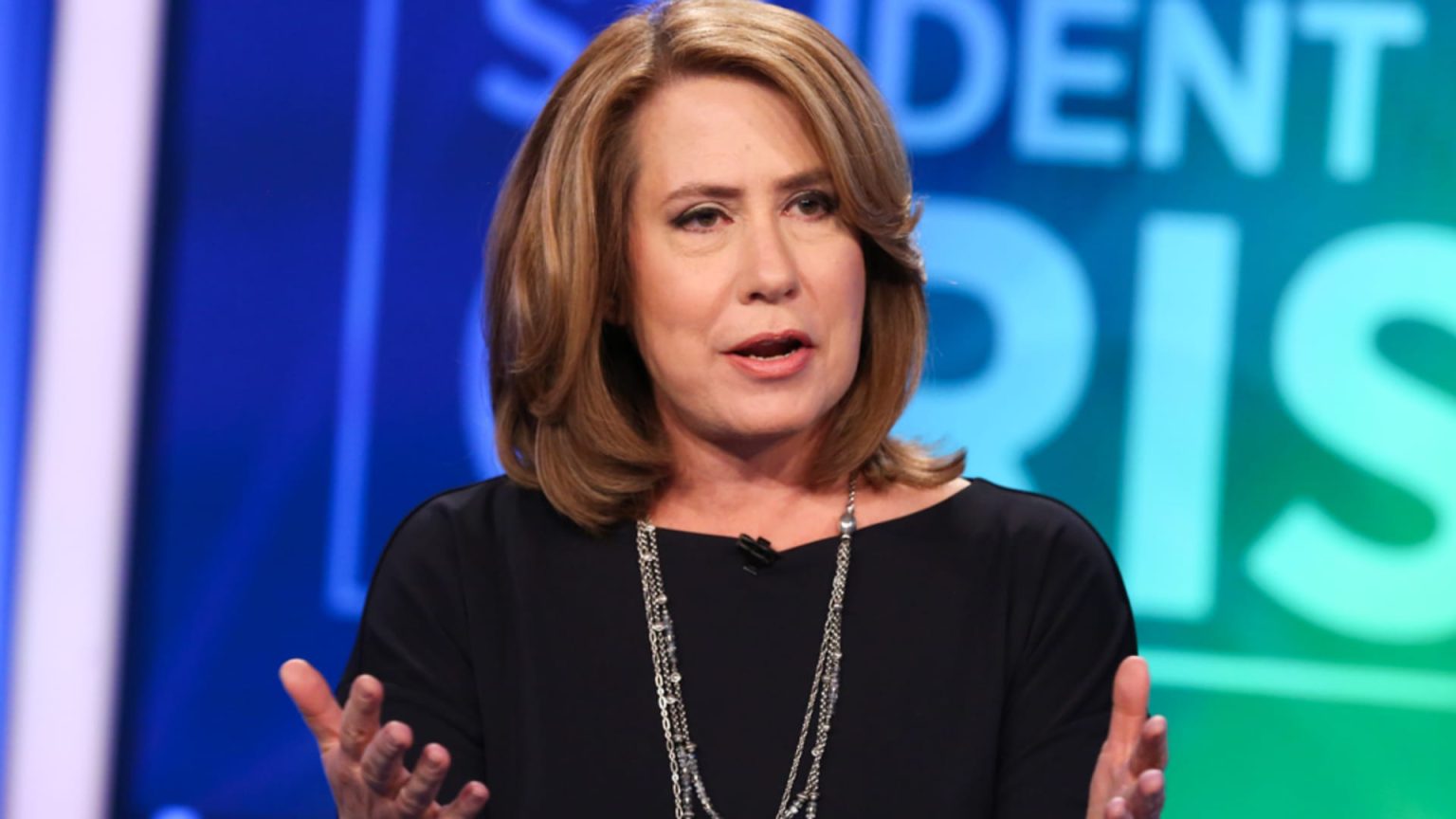

Regionbank earnings may reveal concerning weaknesses, according to former FDIC chair Sheila Bair. She expressed worries about regional banks still relying heavily on industry deposits, having significant exposure to commercial real estate, and facing potential instability of uninsured deposits. Bair highlighted the need for Congress to reinstate the FDIC’s transaction account guarantee authority to stabilize deposits and prevent potential failures. The performance of regional banks has been poor in 2024, with the SPDR S&P Regional Bank ETF down almost 13% and several members experiencing significant declines.

New York Community Bancorp has been the biggest laggard in the KRE, falling over 71% this year. Other members such as Metropolitan Bank Holding Corp., Kearny Financial, Columbia Banking System, and Valley National Bancorp are down more than 30% in 2024. The primary concern for regional banks, according to Bair, is the potential impact of another bank failure on uninsured deposits. With the benchmark 10-year Treasury note yield surpassing 4.6%, higher yields could further stress commercial real estate borrowers, an area where regional banks have substantial exposure, increasing the likelihood of borrower distress.

Bair emphasized the challenges facing regional banks, particularly regarding commercial real estate refinancing, which could lead to borrower distress as interest rates rise. She also highlighted the potential for larger institutions to benefit from regional bank distress, as clients may shift their business to more stable institutions. The uncertain economic environment and the possibility of another bank failure make it crucial for regional banks to address their vulnerabilities and mitigate risks. The performance of regional banks in 2024 indicates underlying issues that need to be addressed to ensure stability and resilience in the banking sector.

As quarterly numbers for regional banks begin to hit Wall Street, Bair’s warnings about potential weaknesses in the sector gain significance. The need for regulatory interventions, such as reinstating the FDIC’s transaction account guarantee authority, to stabilize deposits and prevent failures becomes more urgent. The performance of regional banks in 2024, with significant declines in stock prices and concerns about exposure to commercial real estate and uninsured deposits, raises red flags about the sector’s health and resilience. Monitoring the challenges faced by regional banks and taking proactive measures to address vulnerabilities is essential to safeguarding the stability of the banking sector and minimizing the risk of potential disruptions.