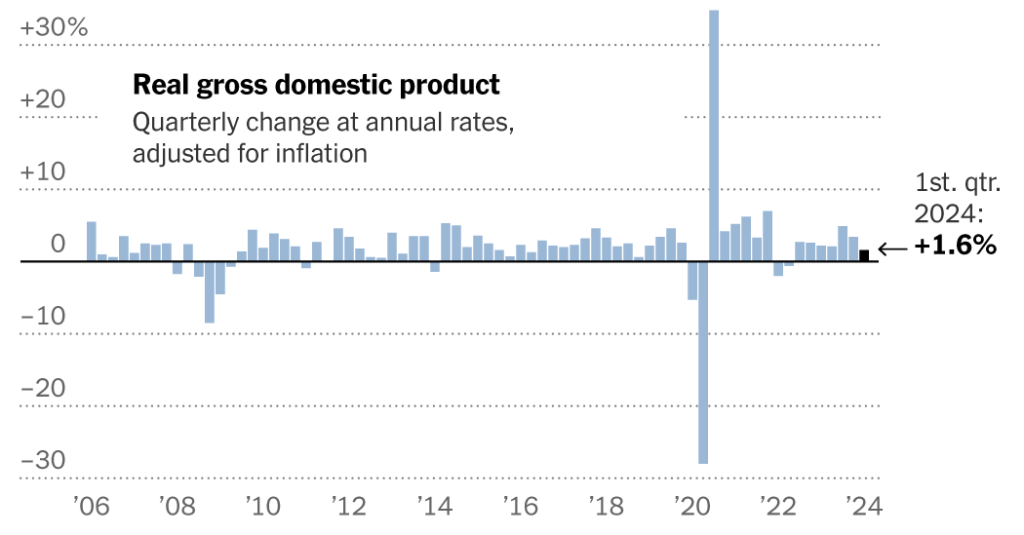

In the first quarter of 2024, the U.S. economy experienced a slowdown, with gross domestic product (GDP) growing at a 1.6 percent annual rate, down from 3.4 percent in the previous quarter. Factors such as higher prices and weaknesses in certain sectors contributed to this deceleration. However, underlying growth remained strong, according to Michael Gapen, chief U.S. economist for Bank of America. While the Federal Reserve had been trying to cool off the economy, the slowdown was not seen as worrisome overall.

Despite the slowdown in overall growth, consumer spending remained a key driver of economic activity in the first quarter. With low unemployment and rising wages, consumers continued to spend, contributing to a 2.5 percent increase in spending. Income growth outpaced inflation, although consumers saved less as they maintained their spending habits. Brian Rose, senior economist at UBS, noted that while sentiment about the economy was not strong, consumers were still spending, defying expectations and keeping growth on track.

Business investment and inventory additions were weaker in the first quarter, signaling caution among businesses despite strong sales. James Knightley, chief international economist for ING, highlighted the importance of consumer spending in driving overall growth, emphasizing that any disruption in consumer behavior could quickly unravel the growth story. The reliance on wealthier consumers, who have been shielded from high interest rates and benefit from a strong stock market, has been a significant factor in driving spending.

Lower-income households, on the other hand, are facing increasing financial strain, as they rely more on credit cards to maintain their spending. With higher interest rates, more of these households are falling behind on payments, indicating a growing division within the U.S. economy. Andrew Husby, senior U.S. economist at BNP Paribas, pointed out this growing disparity, suggesting that lower-end households are increasingly stretched financially. This divergence in consumer behaviors highlights the challenges faced by different segments of the population in the current economic environment.

The Federal Reserve’s fight against inflation has hit a roadblock, as prices rose more quickly in the first quarter than anticipated. This acceleration in prices, coupled with the slower growth rate, raises concerns about a potential harder economic landing. Constance L. Hunter, an economist at MacroPolicy Perspectives, warned of the risks associated with the current economic conditions, indicating that high-interest rates may not be fully effective in controlling inflation. The delicate balance between economic activity and inflation remains a key concern for policymakers and economists.

Looking ahead, the sustainability of consumer spending will be crucial to the continued growth of the U.S. economy. While businesses have been cautious in their investments, consumer confidence and spending have remained resilient. However, with signs of strain emerging among lower-income households and ongoing challenges related to inflation and interest rates, the economic outlook remains uncertain. Finding a balance between supporting consumer spending and managing inflation will be essential in navigating the evolving economic landscape in the coming months.