The financial markets were on edge as they awaited the Fed meeting and the release of the jobs report, both of which were expected to be significant market movers. Surprisingly, the weaker-than-expected jobs report seemed to be viewed positively by investors, sparking bullish activity in the equity markets, with the Nasdaq, S&P 500, and Dow Jones all ending the week up significantly.

During the Fed meeting on April 30 – May 1, Chairman Powell reassured the market that the slight increase in inflation data was just a bump in the road and that the Fed saw the path to its 2% inflation goal as clear. Powell’s dovish stance during the meeting and press conference signaled a departure from previous meetings, easing market concerns about tightening policy in response to inflation.

Following the release of the Non-Farm Payrolls report on May 3, which showed weaker-than-expected job growth and rising unemployment rates, the market’s expectations shifted towards the possibility of two rate cuts this year, a significant increase from earlier projections. The Fed’s willingness to lower rates in response to unexpected weakness in the labor market further convinced investors that rate cuts were imminent.

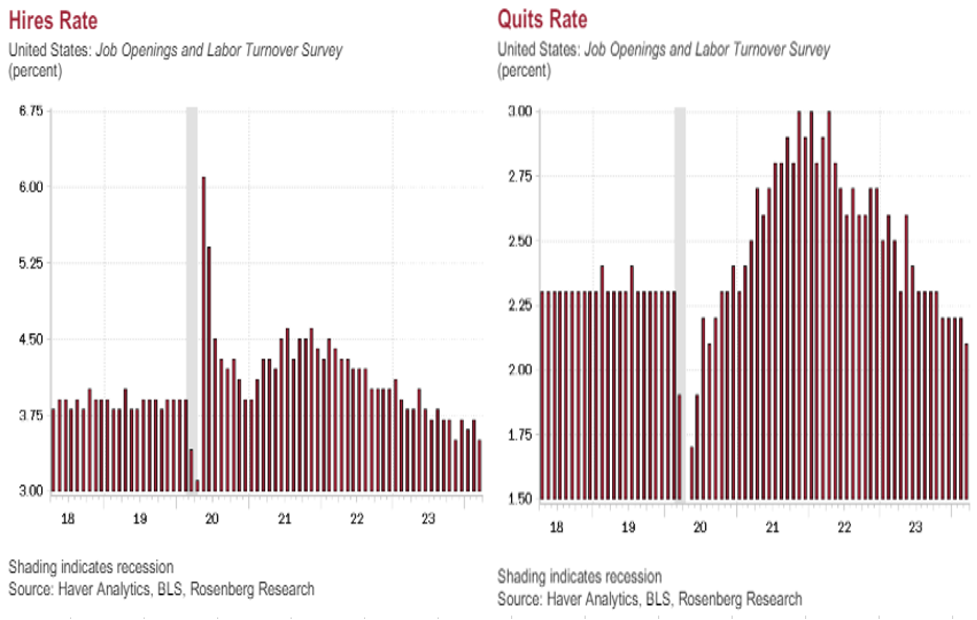

In addition to the disappointing job numbers, other labor market indicators such as the JOLTS report and layoff announcements painted a picture of a rapidly softening job market. The decision to reduce the sales of Treasury securities from the Fed’s portfolio was another sign of easing monetary policy, further fueling optimism in the market.

Earnings reports from major companies like McDonald’s, Coca-Cola, and Nestle highlighted a trend of consumer frugality, with lower same-store sales and warnings of lower profits in the future. Manufacturing data from the ISM’s PMI and other indices showed contraction in the sector, indicating the possibility of a recession. Consumer confidence also fell in April, reflecting growing concerns about the economy’s outlook.

Overall, the Fed’s acknowledgment of a weakening economy and the easing of inflation pressures have set the stage for potential rate cuts in the future. With the job market softening, inflation moderating, and consumer confidence waning, the Fed may need to take action to prevent a recession. Additionally, concerns about commercial real estate foreclosures add to the challenges facing the economy, with small and regional banks likely to face significant write-offs in the coming months.