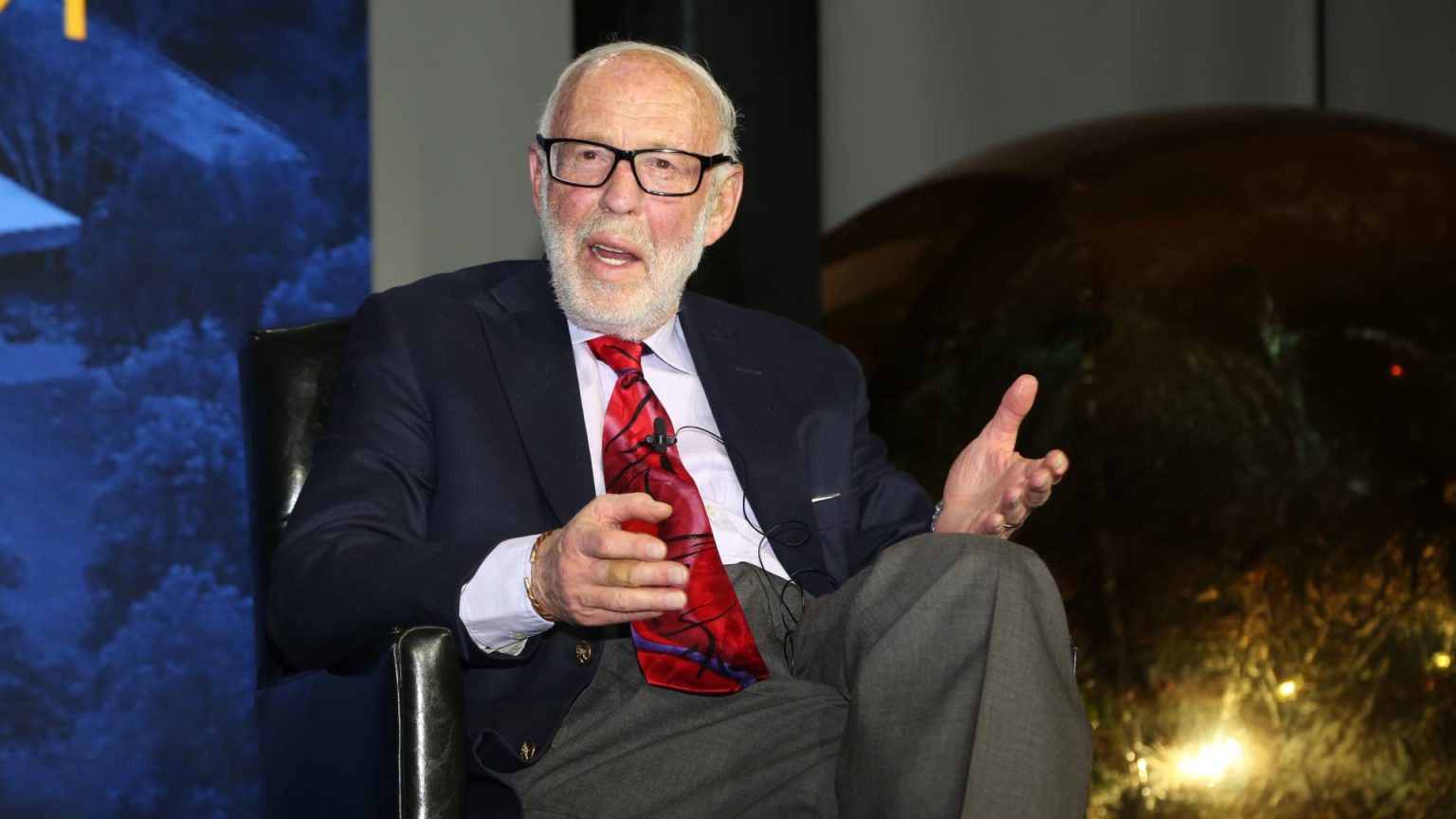

Renowned mathematician and founder of the highly successful quantitative hedge fund Renaissance Technologies, Jim Simons, passed away in New York City. With his pioneering mathematical models and algorithms, Simons achieved unprecedented success in the financial markets, outperforming legendary investors such as Warren Buffett and George Soros. The Medallion Fund, the flagship fund at Renaissance, achieved annual returns of 66% starting in 2018, according to Gregory Zuckerman’s book “The Man Who Solved the Market.”

Simons began his career during the Vietnam War, working as a codebreaker for a U.S. Intelligence organization that focused on cracking Russian codes. He went on to earn a bachelor’s degree in mathematics from MIT in 1958 and a PhD in mathematics from the University of California, Berkeley at the young age of 23. In 1978, at the age of 40, Simons founded what would become Renaissance Technologies after leaving academia to pursue trading. Unlike traditional investors, Simons relied solely on automated trading systems to exploit market inefficiencies and trading patterns.

The Medallion Fund, managed by Simons, generated over $100 billion in trading profits between 1988 and 2018, with an annualized return of 39% after fees. The fund was closed to new money in 1993, with Simons only allowing his employees to invest in it starting in 2005. Simons’ revolutionary quantitative strategies have since reshaped Wall Street, with quant funds now accounting for more than 20% of all equity assets, as estimated by J.P. Morgan. Simons’ net worth was estimated at $31.4 billion at the time of his passing, according to Forbes.

In addition to his successful financial career, Simons was also a respected academic, having chaired the math department at Stony Brook University in New York. His mathematical breakthroughs have made significant contributions to fields such as string theory, topology, and condensed matter physics. Simons and his wife established the Simons Foundation in 1994, through which they have donated billions of dollars to support math and science research, among other philanthropic causes. Simons remained active in the work of the foundation until the end of his life.

Jim Simons is survived by his wife, three children, five grandchildren, and a great-grandchild. His legacy as a pioneering mathematician and successful quantitative investor will continue to inspire future generations in both academia and finance.