In 2023, global merchant payment processing and acquiring net revenue surpassed $91 billion, with projections indicating that this figure will exceed $171 billion by 2030, according to S&P Global Market Intelligence’s 451 Research. As the market continues to grow, enterprises and investors are faced with a crowded landscape of vendors, making it challenging to differentiate between industry leaders and lagging contenders. In response to this challenge, the FAST framework was developed to help payment technology buyers and market stakeholders assess merchant payment processor vendors more effectively.

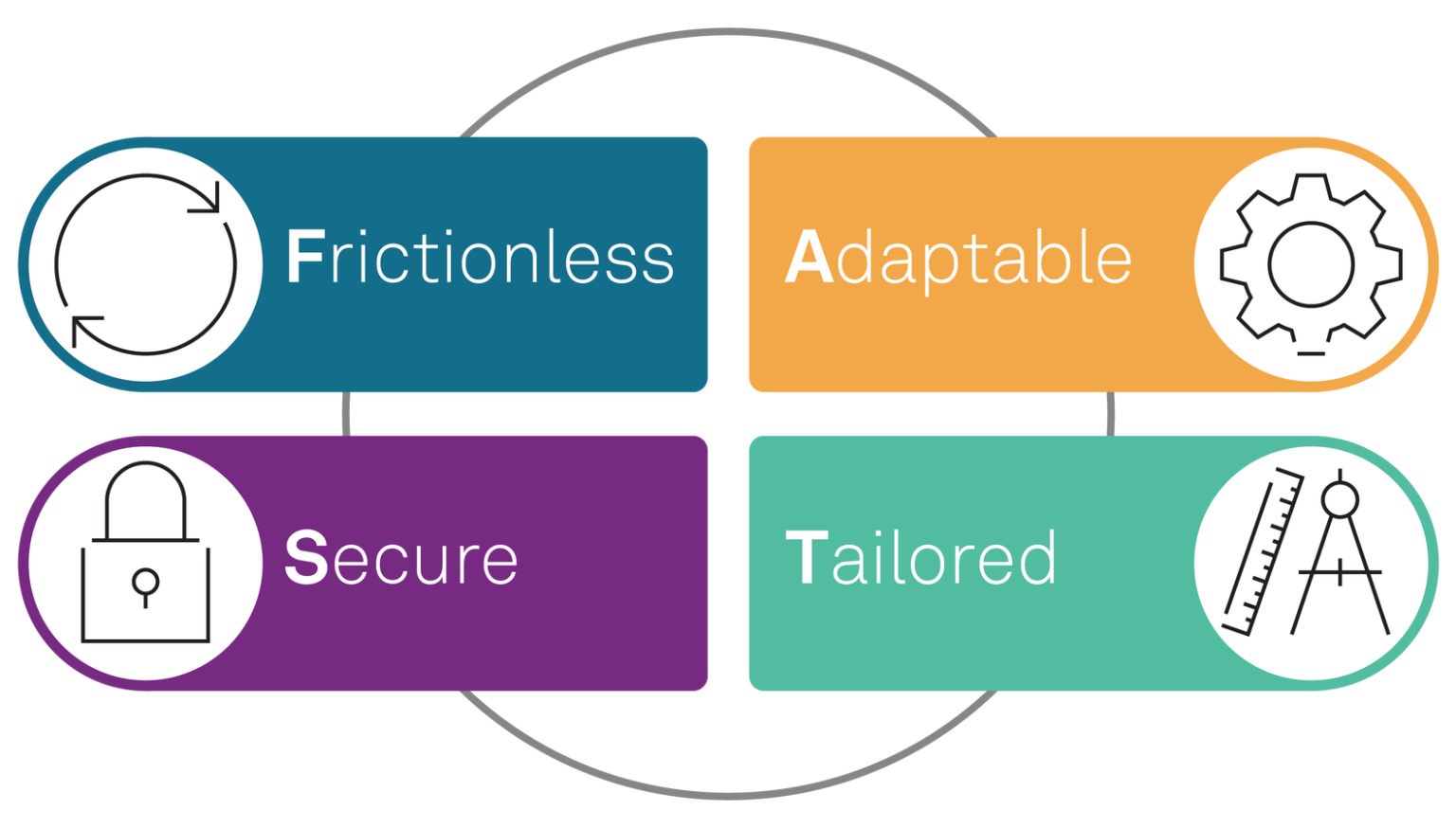

The FAST framework categorizes key capabilities and attributes into four main areas: Frictionless, Adaptable, Secure, and Tailored. These categories serve as a tool for evaluating vendors, understanding the depth and breadth of their offerings, and determining their potential to drive business outcomes for merchant end users. Each of these areas is explored in greater detail to provide a comprehensive perspective on the merchant payment processor landscape.

The Frictionless aspect of the FAST framework focuses on creating a seamless payment experience for consumers and merchants alike. It evaluates attributes such as alternative payment methods, ease of integration, global connectivity, and insight generation capabilities. These features are essential for driving conversions, expanding business reach, and unlocking valuable insights that can be used to optimize costs and drive revenue growth.

Adaptability is another key aspect of the framework, emphasizing the importance of creating efficiencies and flexibility in responding to market shifts and opportunities. Attributes such as uptime and scalability, optimizers for driving revenue growth, a single platform for unified processing, omnichannel capabilities, and additional services beyond core processing are key considerations for assessing a merchant payment processor’s adaptability.

Security is a fundamental pillar of merchant payment processing, with providers differentiating themselves by implementing advanced security measures to improve performance and customer experience. Key security attributes highlighted in the framework include dynamic network tokens and EMV’s 3-D Secure, fraud prevention capabilities, tools for minimizing chargebacks, and data privacy and security features that reduce compliance burden and enhance transaction security.

Lastly, the Tailored aspect of the framework underscores the importance of offering flexible and customized capabilities that align with the unique business requirements and priorities of customers. Attributes such as local expertise, vertical and business model expertise, robust support services, and a strong partner ecosystem are crucial for delivering tailored solutions that meet the diverse needs of merchants operating in various industries and markets. By considering these key attributes within the FAST framework, stakeholders can make more informed decisions when evaluating merchant payment processor vendors.