The Biden administration has approved an unprecedented amount of student loan forgiveness for over four million borrowers, with potential for more relief in the future. The Education Department has implemented changes and updates to student debt programs, including accelerating progress toward loan forgiveness under income-driven plans and expanding the Total and Permanent Disability discharge program. There have been $153 billion in student loan forgiveness approvals thus far, with the possibility of more under a new program that is in the works.

One way borrowers can apply for loan forgiveness is through the IDR Account Adjustment, which automates relief for government-held federal student loans. Borrowers with other types of federal loans must submit a Direct consolidation application by April 30th to be eligible. Similarly, those seeking loan forgiveness under the Public Service Loan Forgiveness program need to meet certain requirements and submit applications by the deadline. The program itself will be undergoing a temporary shutdown from May 1st to July, during which no processing will occur.

Borrowers with medical conditions preventing them from maintaining significant employment may qualify for student loan forgiveness through the Total and Permanent Disability discharge program. The Biden administration has made changes to this program, expanding the types of medical providers who can certify eligibility and broadening the categories of individuals who can qualify for automatic relief. The process may undergo a temporary pause later this year, similar to the one for the PSLF program.

The Borrower Defense to Repayment program allows borrowers to request loan forgiveness if they were misled by their school about their degree or certificate program. Despite updates to the program regulations last summer, a legal challenge has resulted in a pause for applications under the new, more borrower-favorable rules. Borrowers can still apply, but decisions may be delayed due to the ongoing legal process. The Education Department is unable to use the updated regulations until the legal situation is resolved.

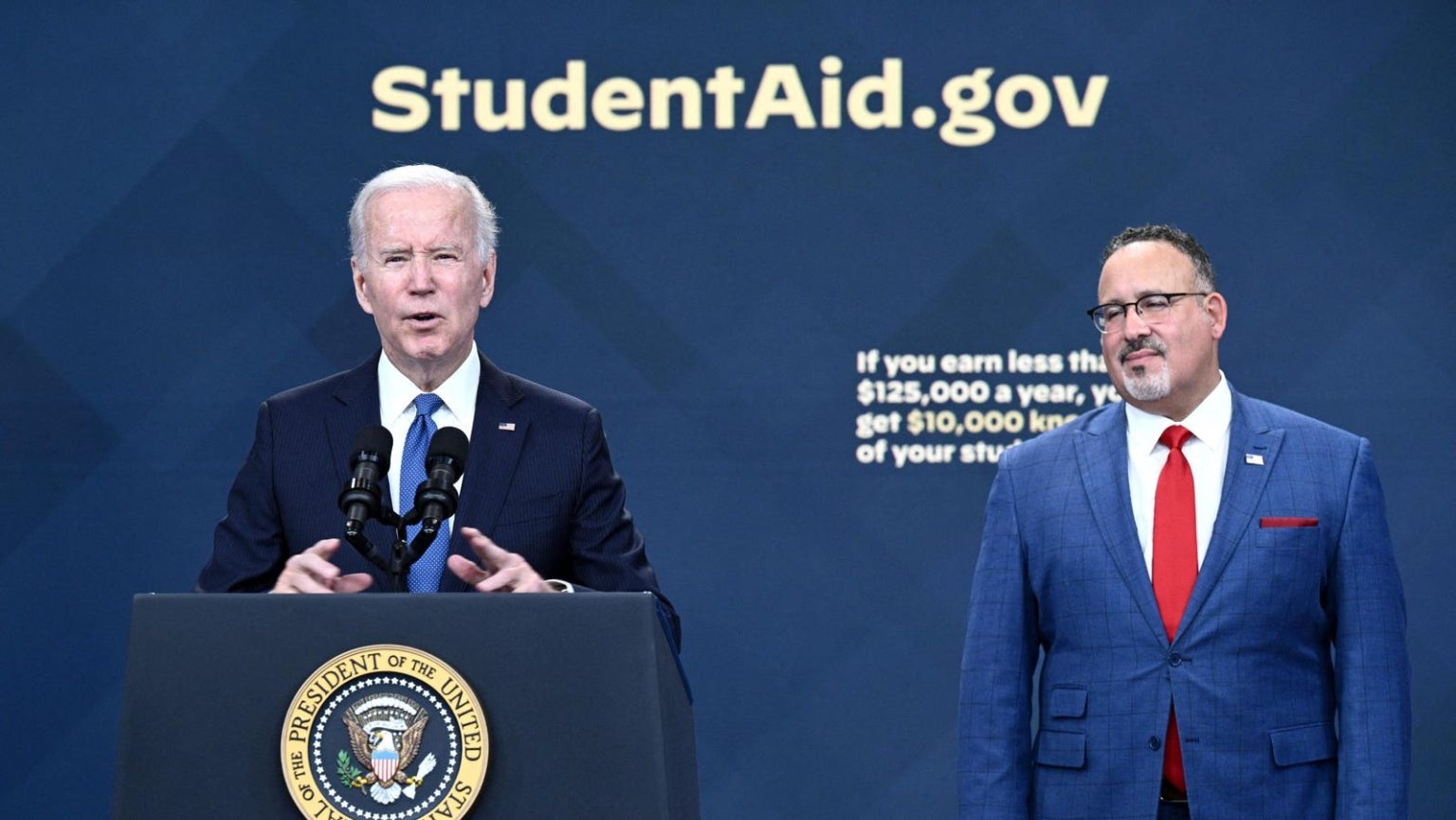

President Biden recently announced a forthcoming student loan forgiveness plan as a replacement for the one struck down by the Supreme Court last year. The new initiative aims to provide relief to borrowers facing various circumstances, with some potentially eligible for automatic forgiveness. Others may need to submit applications for loan forgiveness, although the details and application process are still pending. The program is expected to undergo further steps before launching, with a possible start date by this fall. Legal challenges are anticipated, as is routine for such initiatives.