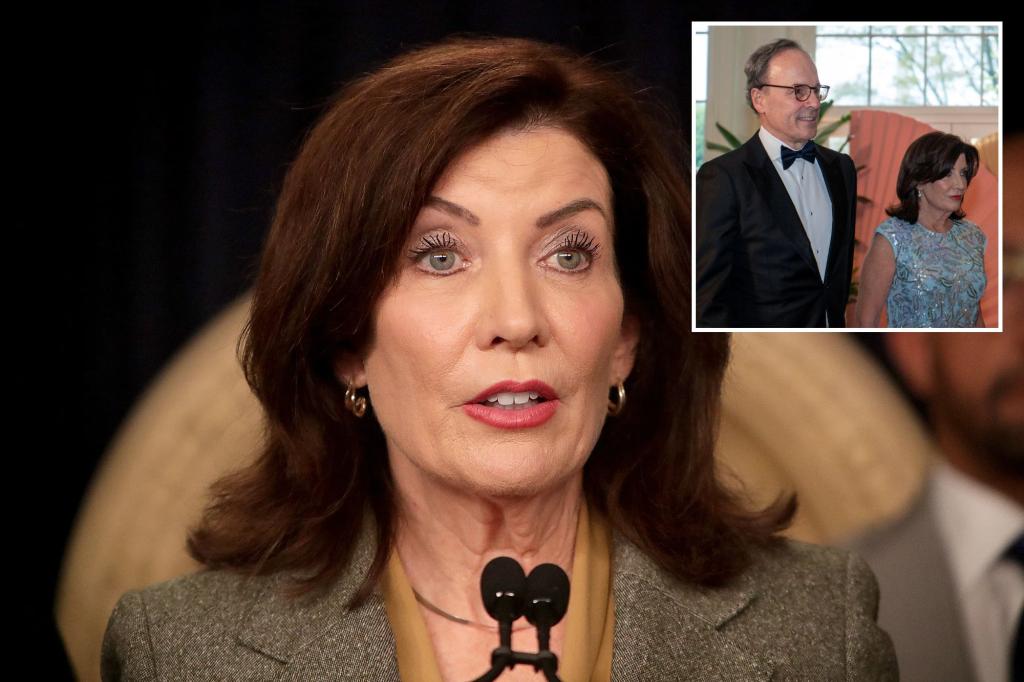

Governor Kathy Hochul and her husband saw a significant increase in income in 2023, with an adjusted gross income of around $2 million, up $1 million from the previous year. The couple paid $610,000 in federal taxes and $123,090 in state taxes, with Bill Hochul being the primary earner, making roughly $1.5 million from his employer Delaware North. In 2022, he earned $650,375 from the same job. The couple also made more charitable donations in 2023, contributing $84,780 through stocks to various organizations, compared to $58,424 in 2022.

Despite the increase in income, Governor Hochul and her husband are not obliged to make their tax returns public. Bill Hochul reported additional income in 2023, including $80,579 in deferred payments from Delaware North and $45,544 in pension payouts from his time as a federal prosecutor. Additionally, they received $43,292 in dividends and $18,756 in interest payments. Hochul’s office did not provide any comments on the matter when requested.

The tax documents revealed that the couple donated 40 shares of Microsoft stock, valued at approximately $14,000, to the Franciscan Sisters of St. Joseph in Hamburg, among other charitable gifts. Their total charitable contributions in 2023 amounted to $84,780, compared to $58,424 in 2022. Bill Hochul’s income from Delaware North increased significantly in 2023, with him earning $1.5 million before leaving the company in the summer, while in 2022, he made $650,375 from the same job.

In total, the Hochuls paid $733,090 in taxes in 2023, a significant increase from the previous year. Bill Hochul’s additional income from deferred payments and pension payouts contributed to their higher adjusted gross income. The couple also received dividends and interest payments in 2023, adding to their total income for the year. Despite their increased income, Governor Hochul and her husband are not required to disclose their tax returns publicly, leaving the specifics of their financial situation largely private.

Overall, Governor Kathy Hochul and her husband saw a substantial increase in income in 2023, with their adjusted gross income reaching around $2 million. The couple paid a total of $733,090 in taxes, with Bill Hochul being the primary earner, contributing significantly to their income. Their charitable contributions also increased in 2023, with donations made through stocks to various organizations. Despite their financial success, Governor Hochul and her husband are not obligated to make their tax returns public, and Hochul’s office declined to comment on the matter.