Tax laws can be confusing and have wide-ranging implications, such as filial support laws that could hold family members responsible for medical bills. Pennsylvania has been looking into tweaking their filial law, introducing the “Stop Bankrupting Pennsylvanians Over Family Medical Bills” Act. More Americans are also living and working overseas, presenting tax complexities for estates with international ties. The Senate Budget Committee is addressing offshore tax evasion, with discussions on the Foreign Account Tax Compliance Act (FATCA) and relying on whistleblowers to combat tax evasion by corporations and high-net-worth individuals.

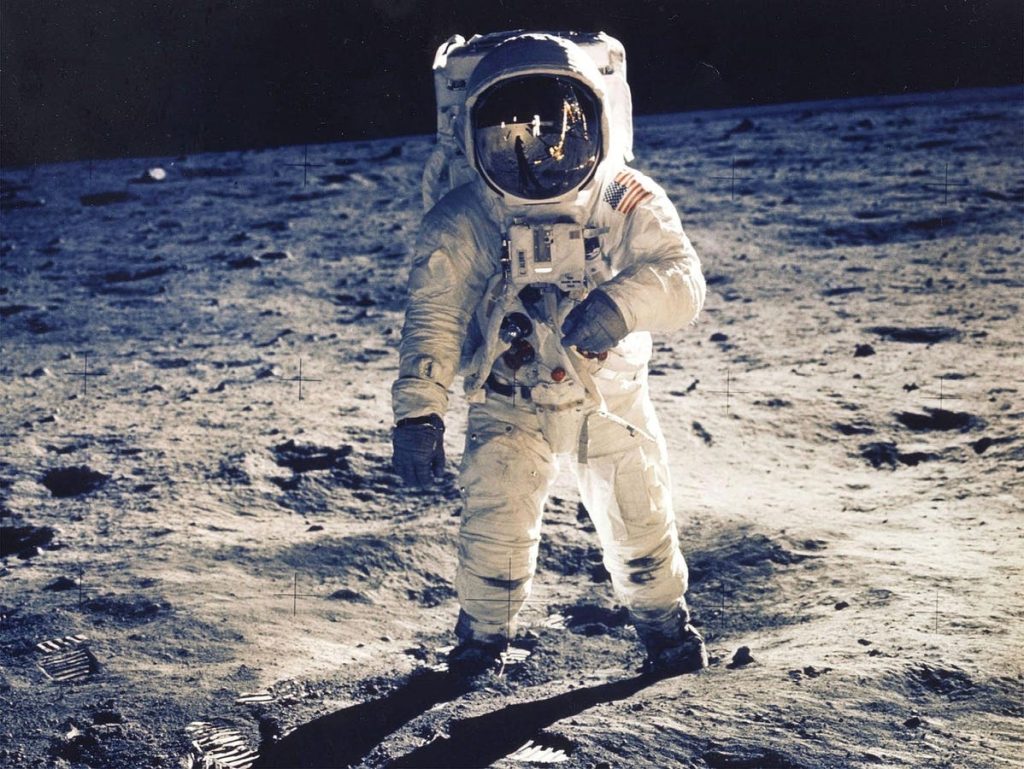

The IRS is enhancing efforts to regulate crypto and digital assets. Form 1099-DA has been drafted to report sales and exchanges of digital assets to the IRS, following proposed regulations from last year. New tax proposals are also being considered, including a potential excise tax on private space companies like SpaceX and raising the federal capital gains rate to 44.6% for high-income taxpayers. Additionally, the FTC reported that Americans lost over $10 billion to theft and fraud in 2023, leading to uncertainties around theft loss deductions and state and local tax deductions.

A recent IRS Direct File pilot program was successful, with over 140,000 taxpayers filing their federal tax returns using the new service. Important tax dates include the ABA Section of Tax May Tax Meeting in Washington, DC, and the deadline for filing refunds for tax year 2020 on May 17, 2024. Noteworthy developments in the industry include a potential fall of Chevron deference in courts and the launch of the IRS Direct File tool, improving tax filing experiences for users. Additionally, the Tax Law Center has unveiled a new online tool for policymakers to navigate tax system improvements.

Case law developments are also worth watching, such as the Farhy v. Commissioner of Internal Revenue ruling that questioned the IRS’s legal authority to assess civil penalties and automatic audits. Another case, Townley v. United States, involves a tax refund lawsuit based on charitable deductions for conservation easements. The Tax Notes podcast discusses the potential implications of a post-Chevron world and heightened judicial oversight over regulatory interpretations in the tax realm.