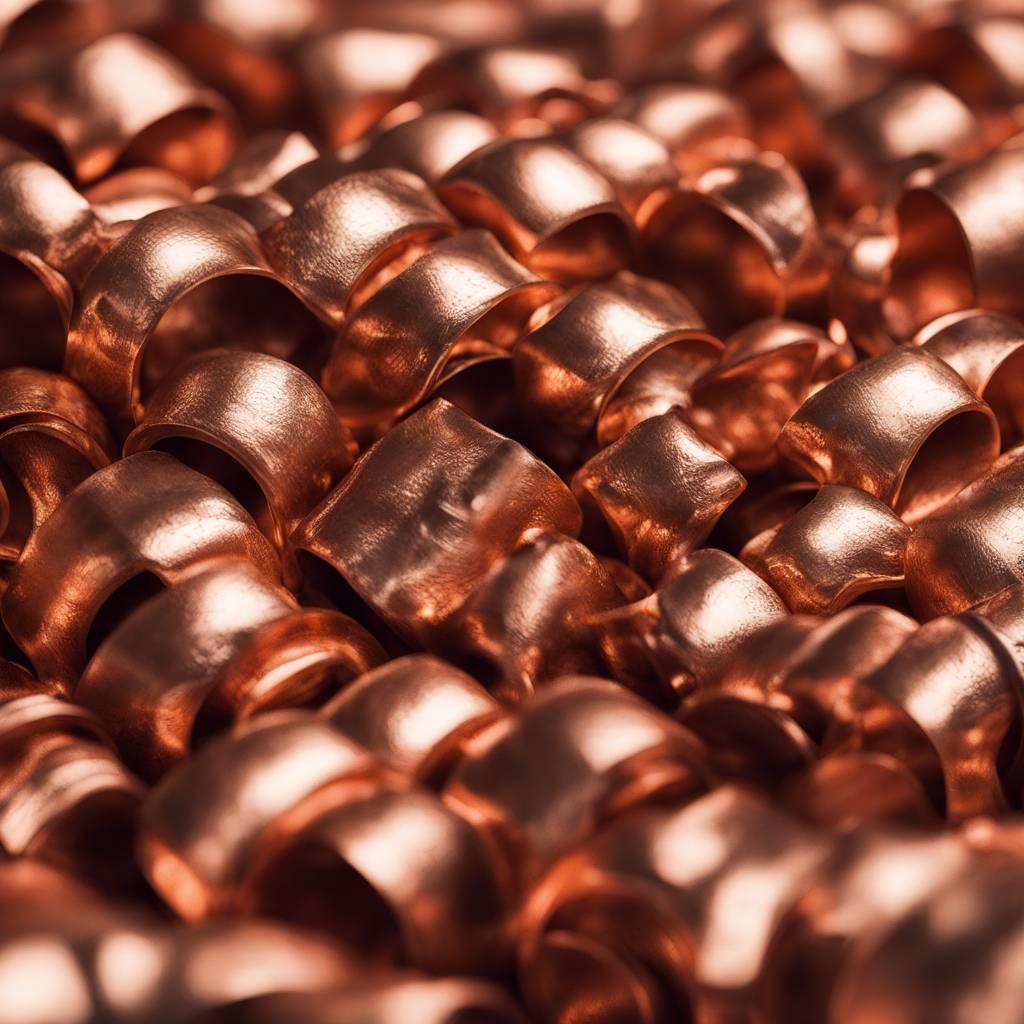

The copper market is currently experiencing a surge in price, reaching over $9000 per pound, with predictions of hitting $11,000 per pound in the near future. This increase is attributed to a combination of supply constraints, such as the closure of a major copper mine in Panama, and strong demand for the metal. Investment banks including Citi, Goldman Sachs, and Morgan Stanley have all recommended increased exposure to copper to their clients, despite some caution due to previous optimistic forecasts that failed to materialize.

In 2022, Goldman Sachs had predicted copper prices to reach $13,000 per ton in 2023, but instead, the price dropped to $7150 per ton. Since then, copper has been on a steady upward trend, currently priced at $9200 per ton, with expectations of continued growth. The latest assessment from Goldman Sachs suggests a potential price rise to $9900 per ton by 2028, leading to a search for new copper production technologies that can extract metal from low-grade ore.

Morgan Stanley also sees the tight supply and demand fundamentals of the copper market as a driving force behind the metal’s rise in price. The bank forecasts copper to reach $10,200 per ton by the third quarter of 2024. Citi, on the other hand, has revised its forecast to a more gradual increase, with copper expected to reach $12,000 per ton over the next two years. The bank attributes this more cautious approach to the uncertain macroeconomic environment.

Smaller banks and broking houses, such as ING and Wilsons, are also showing interest in copper but with a more cautious approach compared to the U.S. banks. ING believes that the bull run for copper has just begun and expects further price increases as supply constraints continue to drive prices. Wilsons, an Australian advisory firm, highlights copper as a standout commodity in a challenging year for the resources sector, with spot prices approaching a 12-month high.

Overall, the bullish sentiment towards copper is driven by a combination of supply constraints, strong demand, and expectations of continued price growth. While some caution remains due to past forecasting missteps, the general consensus is that copper prices are expected to rise in the coming years, with various banks and financial institutions predicting different price targets. The search for new technologies to extract copper from low-grade ore and the overall positive outlook for the global economy are also factors contributing to the optimistic outlook for copper.