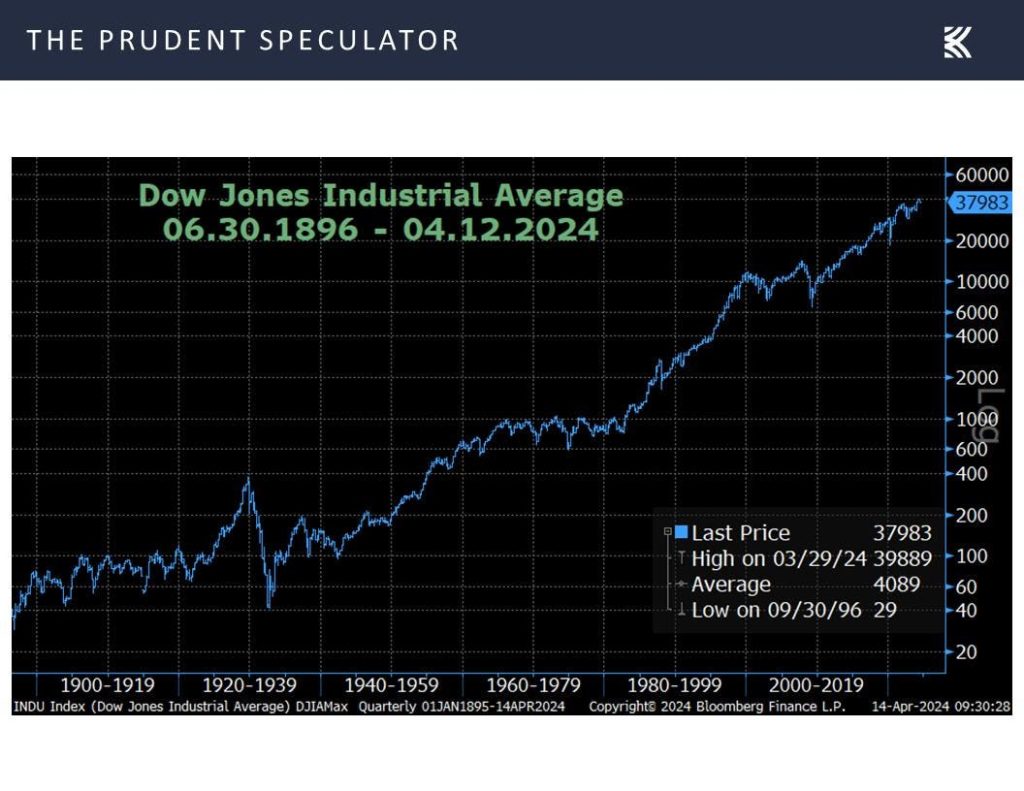

Last week, the Dow Jones Industrial Average experienced two days of losses totaling more than 400 points each, resulting in a total loss of over 900 points for the week. This trend continued into the current week, with the index closing lower despite an early increase on Monday. This volatility serves as a reminder that short-term setbacks are a normal part of investing in stocks, despite the long-term upward trend seen in the Dow over time.

Looking back at historical data, the S&P 500 has experienced 5% or greater drops without corresponding gains three times a year on average, while 10% corrections occur approximately every 11 months and 20% bear markets occur every 3.4 years on average. Last week, traders were concerned not only about unrest in the Middle East but also about higher-than-expected inflation at the consumer level for March. The full Consumer Price Index (CPI) rose 3.5% year-over-year, while the core CPI, which excludes volatile food and energy prices, climbed 3.8%.

Despite the market’s reaction to inflation and uncertainty, it is important to note that historical data shows that equities have performed well over the long term regardless of inflation levels. Value stocks, in particular, have shown strong performance both during times of rising and falling CPI, as well as after periods of high or low inflation. These trends suggest that investors may be overlooking the potential benefits of holding onto stocks during periods of market volatility.

One stock in the spotlight last week was Citigroup, which reported its Q1 financial results. The firm exceeded earnings per share expectations, driven by growth in U.S. Personal Banking and Services. Despite a year-over-year decrease in earnings, revenue increased by over 3%, offsetting declines in other sectors. The company also announced restructuring charges aimed at simplifying its organizational structure, with expected cost savings in the future.

CEO Jane Fraser highlighted the company’s focus on transformation and performance, emphasizing the importance of simplifying the organization to improve efficiency and enhance the client experience. With a strong balance sheet and ongoing efforts to reduce expenses, Citigroup has shown progress in its transformation journey. The market has begun to recognize this progress, with the stock trading at a low earnings multiple and below tangible book value, offering potential upside for investors.

Overall, the recent market volatility serves as a reminder that short-term fluctuations are to be expected when investing in stocks. By focusing on long-term trends and historical data, investors can better navigate market uncertainty and identify potential opportunities for growth. Stocks like Citigroup, with a focus on simplification and cost reduction, offer potential for long-term gains despite short-term challenges. Investors should continue to monitor market trends and consider their investment strategies accordingly.