Americans’ confidence in their ability to have enough money to live comfortably in retirement has fallen significantly in the past year, with new research showing that this confidence has not recovered. Factors contributing to this lack of confidence include concerns about an increasing cost of living that makes it harder to save, as well as potential changes to the retirement system by the U.S. government. The research found that both workers and retirees are relying on three main sources of income in retirement: Social Security, workplace retirement savings plans, and personal retirement savings or investments.

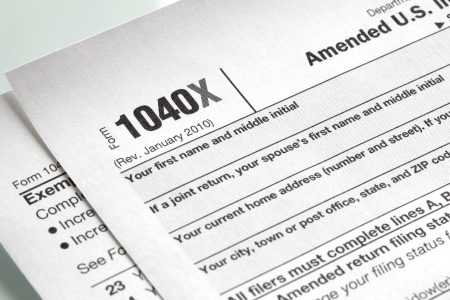

The potential depletion of Social Security and Medicare trust funds in the next decade could lead to significant benefit cuts, making it essential for Congress to take action to prevent this. Changes in tax breaks to retirement savings could also impact retirement planning for many Americans. Social Security consistently ranks as a top issue for AARP members, and the organization is urging lawmakers to take positions on the program. A recent survey by AARP found that 20% of Americans aged 50 and older have no retirement savings, and 61% worry they will not have enough money in retirement.

In response to the retirement insecurity many Americans face, AARP is advocating for legislative proposals to improve retirement security. This includes providing retirement savings accounts or automatic IRAs for those who do not have access to employer-sponsored plans. While recent legislation has aimed to address retirement security, the effects may be limited for those close to retirement. Changes such as allowing savers in their 60s to make additional catch-up contributions and providing a match for low-income workers have been implemented, but more comprehensive solutions may be needed.

The research from the Employee Benefit Research Institute and Greenwald Research also highlighted the challenges women face in retirement, particularly related to family caregiving responsibilities that can contribute to economic insecurity. AARP is advocating for measures to address these issues, as well as pushing for improvements to retirement security overall. With concerns about potential changes to Social Security benefits and other retirement savings vehicles, many Americans are feeling uncertain about their financial futures.

Overall, the survey results indicate a lack of confidence among Americans when it comes to their retirement savings and prospects. With concerns about rising costs, potential changes to Social Security, and other factors impacting retirement planning, many individuals are struggling to feel secure about their financial futures. AARP and other advocacy organizations are working to address these issues and push for legislative solutions to improve retirement security for all Americans, particularly those who are closest to retirement age.