In recent weeks, Coinbase Global (COIN), a prominent player in the blockchain and Bitcoin industry, has faced challenges in the stock market. The company’s stock has dropped significantly, falling 19% in April and 25% from its two-year high in March. However, analysts believe that this setback may be temporary, as historical data indicates a potential bullish trendline approaching.

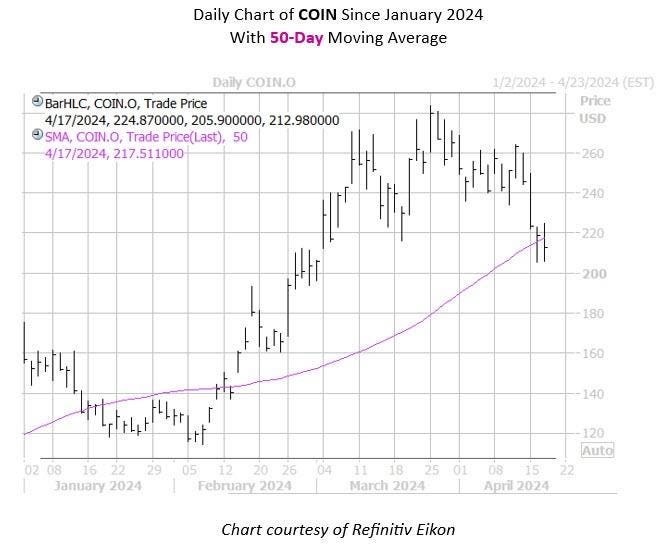

Data from Senior Quantitative Rocky White shows that COIN has come within one standard deviation of its 50-day moving average after consistently trading above it for some time. This pattern has occurred three times in the past three years, with the stock showing a 67% chance of being higher one month later, with an average gain of 11%. If this trend continues, COIN could see a significant increase in value, potentially reaching around $235.61 from its current level of $212.27.

One factor that could contribute to COIN’s rebound is a potential short squeeze. While short interest has decreased by 10% in recent reporting periods, there are still 11.63 million shares sold short, accounting for 6.3% of the total available float. Despite the recent decline in stock price, COIN is up 22% in 2024, which could prompt analysts to revise their ratings. Currently, 12 out of 20 analysts have a “hold” or worse rating on the stock.

Options trading may be a viable strategy for investors looking to capitalize on COIN’s potential recovery. The Schaeffer’s Volatility Scorecard (SVS) for Coinbase Global stock is at 76 out of 100, indicating that the stock has exceeded option traders’ volatility expectations in the past year. This could benefit premium buyers looking to take advantage of potential price movements in the stock.

Overall, despite recent challenges, Coinbase Global (COIN) may be on the verge of a rebound, with historical data and market conditions pointing to a potential bullish trendline. Investors could consider options trading as a strategy to take advantage of potential gains in COIN’s stock price. With a short squeeze and analyst sentiment potentially shifting, COIN’s stock could see a significant increase in value in the near future.