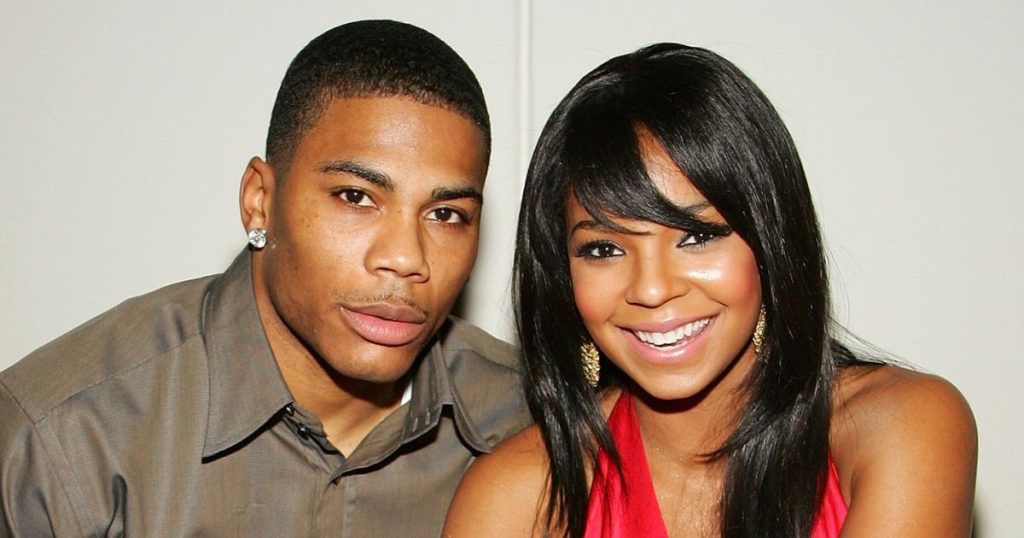

Ashanti and Nelly, who had previously dated and split in 2013, reconciled in early 2023 after a decade apart. The couple had first sparked romance rumors in 2003 and had a series of public appearances and collaborations over the years. Despite their ups and downs, they found their way back to each other and were enjoying spending time together. In September 2023, it was exclusively confirmed that Ashanti and Nelly were expecting their first child together, with Ashanti revealing the pregnancy publicly in an interview with Essence in April of the same year.

The relationship between Ashanti and Nelly began in January 2003 when they first met at a Grammy Awards press conference. They had a playful start, with Nelly asking for Ashanti’s autograph, eventually leading to them exchanging numbers. Over the years, they were seen together at various events and collaborations, including Ashanti bringing Nelly as her date to the premiere of “John Tucker Must Die” in 2006. Despite reports of a split in 2009, they continued to have a close friendship and even attended events together.

In October 2010, Nelly addressed rumors about their relationship, stating that they were friends but did not confirm if they were together or separated. The couple officially split in the summer of 2013, with Ashanti opening up about her feelings of betrayal and the importance of self-growth during an appearance on The Meredith Vieira Show in March 2015. They reunited publicly for the first time in September 2021 during a “Verzuz” battle and were later seen performing together at a concert in December 2022, with Ashanti mentioning that they were in a better place.

Throughout 2023, Ashanti and Nelly continued to fuel reconciliation rumors with public appearances. They were spotted holding hands in Las Vegas in April and attending a red carpet event together in June. Nelly confirmed their rekindled romance in a clip from “Boss Moves with Rasheeda,” expressing surprise at how their relationship had evolved. In October, Nelly posted a heartfelt birthday message to Ashanti, calling her a beautiful and incredible person, and in November, Ashanti surprised him with a vintage car as a birthday gift, leading to emotional reactions from both.

In December 2023, it was exclusively confirmed that Ashanti was pregnant with Nelly’s child. The news came after months of speculation about their relationship and future plans. Ashanti publicly revealed her pregnancy and engagement to Nelly in an interview with Essence, sharing her excitement for motherhood and the support she had received from her family, fiancé, and fans. The couple’s journey from their initial meeting in 2003 to their reconciliation in 2023 and the anticipation of starting a family together showcased the ups and downs of their relationship and their enduring connection.