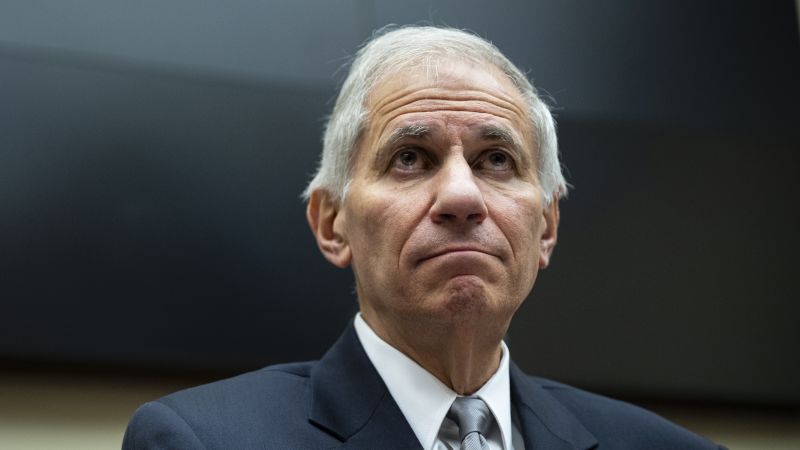

Head of the Federal Deposit Insurance Corporation, Martin Gruenberg, announced his intent to step down following an independent investigation that uncovered pervasive sexual harassment, discrimination, and bullying at the agency responsible for regulating the banking sector. Gruenberg stated that he will fulfill his responsibilities until a successor is confirmed, and Sen. Sherrod Brown called for new leadership at the FDIC. President Joe Biden is expected to announce a new nominee soon, but the confirmation process may take time, potentially leaving the agency deadlocked with one Republican and two Democratic members on the board of directors.

Gruenberg’s decision to remain until a successor is named prevents Vice Chair Travis Hill from automatically becoming chair and potentially stalling significant banking regulations. The White House expressed gratitude for his willingness to stay during the transition period. Top-ranking Republican Sen. Tim Scott criticized the administration for prioritizing politics over protecting workers by allowing Gruenberg to delay his resignation. A report commissioned by the FDIC confirmed a long-standing toxic culture, with Gruenberg’s behavior being highlighted as hindering trust and confidence in leadership.

Despite pressure from some Democrats, Gruenberg testified before lawmakers, taking responsibility for the issues raised in the report. He acknowledged his own failures and expressed regret for not addressing cultural issues at the agency sooner. The FDIC declined to comment further beyond Gruenberg’s statement. While some Democrats expressed outrage at the hearings where Gruenberg testified, others viewed the calls for his resignation as a political exercise. Sen. Elizabeth Warren suggested that Gruenberg see through implementing the report’s recommendations rather than resign.

The FDIC’s workplace culture and leadership issues have come under scrutiny following the release of the independent report. Gruenberg’s decision to step down allows for the agency to transition to new leadership, which is crucial for addressing the issues uncovered. The confirmation of a new nominee by President Biden is expected, but the process could face delays, potentially impacting the FDIC’s ability to implement necessary regulations in a timely manner. Overall, the situation at the FDIC highlights the importance of addressing workplace culture and leadership dynamics in regulatory agencies to ensure effective oversight of the banking sector.