Buy Now, Pay Later (BNPL) options are becoming increasingly popular in the B2B world as they offer companies a way to entice new clients and foster loyalty among existing ones by providing flexible payment terms. While the allure of deferred payments and improved cash flow is undeniable, both businesses and buyers must exercise caution to avoid potential pitfalls associated with this payment structure. Forbes Finance Council members have shared insights into the advantages and disadvantages of BNPL for both companies and clients to consider before pursuing this option.

One advantage of BNPL is that it provides customers with flexibility in how and when they pay for purchases, creating positive customer experiences and driving loyalty. However, businesses offering BNPL should prioritize effective communication, education, and controls to ensure that customers can get the value out of the service without making risky financial decisions. BNPL can also help businesses conserve cash flow by spreading payments over time, making it easier to make larger purchases without straining budgets and incentivizing buyers to make larger orders.

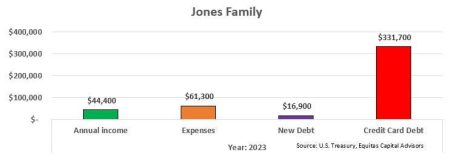

While BNPL may lower the perceived commitment associated with purchases and give buyers more choices to manage cash flow over time, it comes with the risk of overspending. Businesses should also be cautious about potential hidden fees and interests associated with BNPL, as well as the temptation for buyers to overspend and risk future financial stability. BNPL solutions enable customers to retain cash longer, offering a competitive advantage in today’s economic environment, but buyers need to budget and ensure they can make required payments.

BNPL is a game-changer for both buyers and sellers, opening possibilities for price-sensitive customers and eliminating immediate barriers for sellers. However, businesses should be transparent about payment structures to foster loyalty and avoid customer churn caused by hidden fees and interests. While BNPL offers freedom and flexibility, it is important for buyers to be cautious about overspending and potential financial strain, as well as being aware of any contractual obligations, fees, and interest rates associated with the payment option.

Overall, BNPL can help businesses attract new customers, retain loyal customers, and enhance loyalty and buyer satisfaction by offering flexible payment options. However, purchasers must exercise caution to avoid overspending, unstated costs, and debt accumulation. While BNPL offers convenience and improved cash flow management, it may harm credit scores and accelerate debt accumulation if not used responsibly. Companies should consider the terms and implications before implementing BNPL options to ensure responsible usage for both buyers and sellers.