Getting a letter from the IRS can be intimidating, but there are many misconceptions about what an audit truly is and who gets audited. The IRS received a significant financial boost as part of the 2022 Inflation Reduction Act, which will increase enforcement efforts and examinations of large corporations, partnerships, and high-wealth individuals. There are three kinds of notifications that the IRS traditionally sends: adjustment letters, correspondent audits, and examination audits. Adjustment letters inform taxpayers of changes in their refund amount or additional money owed due to miscalculations. Correspondent audits require additional documentation, while examination audits are more thorough and involve less than 1% of Americans in a given tax year.

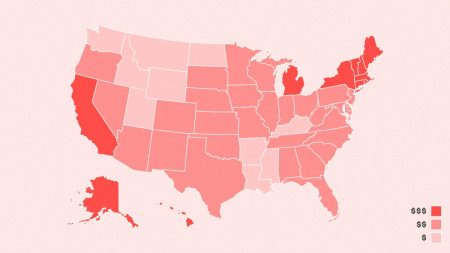

Audit rates have decreased among all income levels in recent years due to a lack of funding, with errors or missing information on a return being a common trigger for audits. Higher-income earners face increased scrutiny, particularly those reporting over $200,000 in income. Millionaires are the most likely to be audited, while declaring little to no income can also raise red flags. Small businesses or households earning $400,000 or less a year are unlikely to see an increase in audit chances, according to Treasury Secretary Janet Yellen and IRS commissioner nominee Danny Werfel.

A Stanford University report revealed racial disparities in audits, with Black taxpayers disproportionately likely to receive audit notices. This is likely due to cost-cutting measures and the IRS’ audit selection methods, which target lower-income individuals more frequently. The IRS is focusing on correspondence audits, which are easier and more cost-effective, leading to disparities in audit rates among different income brackets. The program used to flag errors on returns tends to target lower-income individuals eligible for refunds rather than focusing on high-dollar amounts, raising concerns about fairness in the audit process.

The IRS typically includes returns filed within the last three years in an audit, with most audits focusing on returns filed within the last two years. Audits may extend to additional years if substantial errors are identified. Taxpayers can hold onto their records for at least three years, with six or seven years recommended to cover all bases. The statute of limitations for assessing additional taxes and fees is usually three years after a return was due or filed, but can be extended if necessary. Holding onto tax records for the recommended timeframes can help in resolving audits and providing necessary documentation to the IRS.

In conclusion, receiving a letter from the IRS can be a stressful experience, but understanding the audit process and who is most likely to be audited can help alleviate concerns. By being aware of common triggers for audits, holding onto tax records for the recommended timeframes, and seeking professional assistance if needed, taxpayers can navigate the audit process more effectively. Addressing racial disparities in audits and ensuring fairness in the selection methods used by the IRS are important steps toward a more equitable tax system. Ultimately, being proactive in tax compliance and record-keeping can help individuals and businesses avoid potential audit issues and resolve any discrepancies with the IRS efficiently.