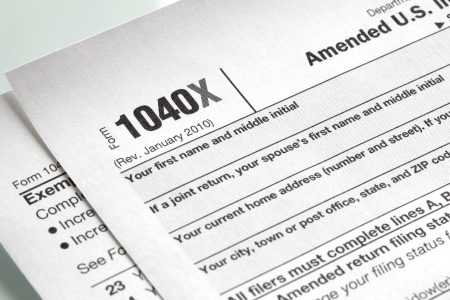

The IRS has unveiled a revised version of Form W-9, Request for Taxpayer Identification Number and Certification, in March 2024. This update introduces new reporting requirements, particularly affecting flow-through entities such as trusts and estates. Understanding these modifications is crucial for trusts and estates attorneys to ensure compliance and accurately advise clients on tax matters.

The revised Form W-9 includes a new requirement for flow-through entities, adding a specific Line 3b for entities with direct or indirect foreign partners, owners, or beneficiaries. This change aims to streamline the process for determining IRS reporting requirements, especially concerning Schedules K-2 and K-3 reporting for entities with international tax relevance. It also clarifies instructions for single-member LLCs to avoid confusion.

The introduction of Line 3b on Form W-9 has direct implications for trusts and estates, especially those involved in transactions with other flow-through entities. This change requires a more detailed examination of the entity’s structure and beneficiaries to accurately complete the form. Trusts and estates with foreign beneficiaries now face increased reporting requirements to disclose their status regarding foreign beneficiaries.

The updated form provides clearer instructions for trusts and estates to comply with IRS reporting requirements more effectively. This clarity is beneficial for entities navigating the complexities of tax reporting and withholding. The question of whether trusts and estates need to refile their W-9 forms has arisen, with specific scenarios where refiling might be necessary, such as in cases where the entity qualifies for a specific exemption for reporting.

The March 2024 revision of Form W-9 brings significant changes for flow-through entities, including trusts and estates. The addition of Line 3b highlights the importance of understanding the entity’s beneficiaries and their statuses for accurate reporting and compliance with IRS requirements. While not all trusts and estates will need to refile their W-9 forms, it is essential for legal professionals to stay informed about these changes and know when a new filing is necessary. Consulting with a tax professional or attorney specialized in trusts and estates is recommended to effectively navigate these updates.